Since most Chinese companies enter India to tap its growing domestic market, it is imperative for them to familiarise themselves with the provisions of the Indian antitrust laws governing competition.

The Competition Act, 2002 regulates anti-competitive agreements, abuse of dominant position and business combinations. In this article we focus on the first two areas.

Partner

DH Law Associates

Anti-competitive agreements

The Competition Act has employed a fairly wide definition of anti-competitive agreements that includes:

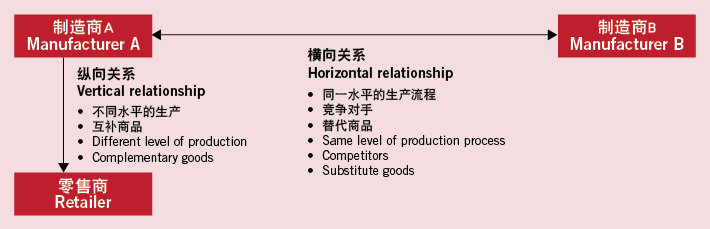

- horizontal agreements that fix prices, provide discounts, outline areas of operations and customers; limit technological innovation, production or supply; and allow bid rigging or collusive bidding;

- vertical agreements involving exclusivity for distribution and purchasing, refusal to deal and fixing minimum resale prices;

- oral or written agreements, arrangements or concerted practice regardless of whether they are enforceable;

- joint ventures between actual and potential competitors that do not increase efficiencies in production and distribution; and

- contact among competitors (including exchanging commercially sensitive information).

Abuse of dominant position

While occupying a dominant position in the market is not by itself illegal, any abuse of such a position that enables a company to operate independently of competitive forces, or which negatively impacts its competitors or consumers, can be deemed to be an abuse of dominance.

The act provides an exhaustive list of practices deemed to be abuse of dominance:

1) Exploitative practices such as:

- unfair or discriminatory pricing including predatory pricing; and

- unfair conditions of purchase on sales of goods and services.

2) Exclusionary practices such as:

- limited production of goods or provision of services or technical development;

- limited, or denial of, access to a market;

- conclusion of contracts subject to unconnected supplementary obligations; and

- use of dominant position in one market to enter into or protect positions in other markets.

D.H.律师事务所

合伙人

Partner

D.H. Law Associates

The Competition Commission of India (CCI) is the sole decision maker in India under the Competition Act, so the jurisdiction of Indian courts has been excluded. The decision of the CCI on merits is final as to whether the Competition Act has been breached,, and currently there are no means to settle a matter or withdraw a complaint. The CCI is empowered as if it were an Indian civil court under the Code of Civil Procedure, 1908, while trying a suit, in addition to being able to regulate its own procedure. This means that the CCI has sufficient powers for search and seizure (also known as dawn raids), requiring discovery and production of documents, and summoning evidence.

Why should Chinese companies pay attention to these rules? The consequences of a breach of the Competition Act are significant:

- breaching the law could cost a company up to 10% of its average turnover for the preceding three years in fines;

- in the case of a cartel, the fines may extend up to the higher of three times the profit and 10% of the turnover for each year of the period of contravention;

- directors, managers, officers and the secretary of the company could be individually fined for their consent, connivance or neglect resulting in a breach of the Competition Act;

- third parties, such as customers or competitors, could bring claims for damages against a company; in some cases, this could even be done by a class action of similarly situated persons claiming to be aggrieved;

- agreements that a company may have executed may be void and may be amended or modified by the CCI if they breach the Competition Act;

- the launch of a formal investigation by the CCI’s Office of the Director General will usually require significant inputs from/involvement of management and significant costs, including legal fees and opportunity costs;

- an investigation or an order against the company could result in adverse publicity and reputational damage;

- competition authorities like the CCI across the world are co-operating with each other – this becomes especially relevant if the company has an international presence. India has already signed co-operation agreements with the US and Russian competition regulators, with many more to come;

- the CCI has already levied heavy penalties on certain companies – for example, some participants in the cement sector were fined a total of INR6,700 crore (US$1.2 billion) for abuses of a dominant position – and the Competition Act has already brought about a paradigm shift redefining the way business is being done in India.

Safeguards

How can Chinese companies safeguard against antitrust violations in India? The best way to manage the risk of antitrust violations is to identify sources of risk such as regular contact with competitors, bundling of products and unconscionable terms of sales.

–

In addition to this, if a company occupies a dominant presence in a certain market, special attention needs to be paid to the manner in which prices are fixed.

In the long term, regular compliance audits of the company and training key employees is the best way to manage anti-trust risks.

Santosh Pai and Nusrat Hassan are partners at DH Law Associates. DH Law Associates is the only full-service Indian law firm with an active China practice since 2010

孟买总部 Headquarters in Mumbai

111, Free Press House

Free Press Journal Road

215, Nariman Point, Mumbai – 400 021

邮编 Postal code:400021

电话 Tel:+91 22 6625 2222

传真 Fax:+91 22 2285 5821

电子邮件 E-mail:

china@dhlawassociates.com

www.dhlawassociates.com