The Authority for Advance Rulings (AAR), in IKEA Trading (Hong Kong) v DIT, on 19 December addressed the issue of whether a liaison office of a foreign entity which facilitates the purchase of goods in India is tax-liable.

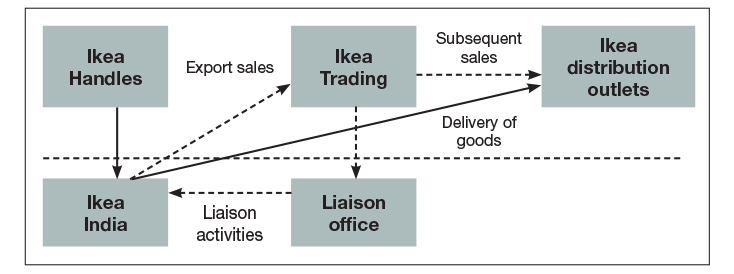

Ikea Trading (Hong Kong) established a liaison office in New Delhi, exclusively for the purpose of organizing the purchase of goods in India. The purchase and export of the goods is contracted to and handled by a separate entity, Ikea India. Ikea India sells and exports the goods to Ikea Trading, which then sells them on to Ikea distribution outlets around the world.

You must be a

subscribersubscribersubscribersubscriber

to read this content, please

subscribesubscribesubscribesubscribe

today.

For group subscribers, please click here to access.

Interested in group subscription? Please contact us.

你需要登录去解锁本文内容。欢迎注册账号。如果想阅读月刊所有文章,欢迎成为我们的订阅会员成为我们的订阅会员。

The legislative and regulatory update is compiled by Nishith Desai Associates, a Mumbai-based law firm that provides legal and tax counselling. The authors can be contacted at nishith@nishithdesai.com. Readers should not act on the basis of this information without seeking professional legal advice.