On 18 March, the China Securities Regulatory Commission (CSRC) announced it would intensify the investigation and handling of unlawful engagement in the business of breaking up privately offered products into smaller units and transferring the same. It stated that “if discovered, the same will be stringently dealt with in accordance with the law”. The CSRC stated that “no institution or individual may offer, sell or transfer privately offered products or the right to benefit from privately offered products to unqualified investors, and a single privately offered product may not exceed the statutory upper limit”.

Basic procedure

“Linghuobao” of LU.com is representative of targeted entrusted investment products. As described in the prospectus for such a product, the targeted entrusted investment product is usually offered through one or more special purpose vehicles (SPVs) and the product is then targeted at earned value managed, dedicated asset management plans, and investment returns are earned via the management of the subject matter of the targeted entrusted investment by the issuing institution.

The investment scope of the subject matter of targeted entrusted investment may include entrusted loans, trust plans (including rights to benefit from a trust), specific/dedicated asset management plans offered by fund companies and their subsidiaries, asset investment plans offered by securities companies, wealth management products of commercial banks, money market funds of fund companies, rights to benefit from notes, bank deposits, etc.

Legal relationship

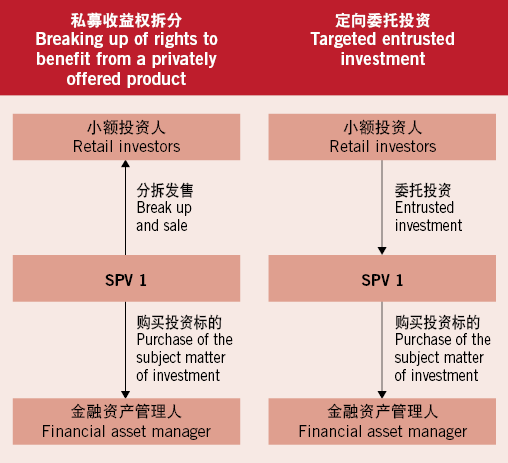

Based on the description of targeted entrusted investment products, there is a difference between their product procedure and the breaking up of rights to benefit from a privately offered product. In the breaking up of rights to benefit from a privately offered product, the privately offered product or other financial product is purchased first, and then broken up into smaller units; whereas in targeted entrusted investment, collection of the funds is completed first, or the fund “entrustment” act is completed first, and then the private equity fund or other financial product is purchased.

The comparison of the legal relationships of the two is shown in the figure. It can be seen that there exists a degree of difference between the two in terms of the fund flow, the provisions on rights and obligations, and the procedural arrangement for the products. Against the background of the CSRC’s call to halt the breaking up of rights to benefit from privately offered products, will targeted entrusted investment products also face similar regulatory pressure? Do such products face major legal or compliance issues?

More similar to trusts

Pursuant to article 2 of the Trust Law, “the term ‘trust’ means the acts whereby the settlor, based on his trust in the trustee, entrusts the rights in his property to the trustee and the trustee manages or disposes of such property in his own name in accordance with the wishes of the settlor for the benefit of the beneficiary or for a specified objective”.

In a targeted entrusted investment transaction structure, the client entrusts the assets to the SPV, as the trustee, which then invests in the subject matter of investment in its own name, a legal structure that is very similar to that of a trust.

As targeted entrusted investment products are mainly directed at non-standardized products and are subject to restrictions on the number of investors and the restriction to qualified investors, a client cannot directly become a direct holder of the rights in the subject matter of the targeted entrusted investment and must hold the same in the guise of a trustee. This is consistent with the features of a trust legal relationship.

Non-trust companies

Pursuant to article 24 of the Trust Law, “a trustee shall be a natural person or legal person with full civil capacity. If laws or administrative regulations contain other trusteeship conditions, such provisions shall prevail.” In accordance with this provision, an ordinary legal person can become a qualified trustee of a trust.

Article 4 of the Trust Law additionally specifies that, “the State Council shall formulate specific measures for the organization and administration of trustees which engage in trust activities in the form of a trust institution”. From the above-mentioned provision it can be seen that article 4 does not apply to the engagement in trust business by entities that are not trust companies. The core of the issue, then, is whether laws or administrative regulations provide otherwise in respect of the conditions for a trustee.

According to reports, article 9 of the Regulations for Trust Companies (Draft for Comment) formulated by the State Council specifies that, “no entity or individual may engage in trust business without the approval of the State Council’s banking regulator”. However, the regulations are still at the comment stage and have not been officially promulgated.

The Trust Law specifies that a legal person may serve as the trustee of a trust while additionally specifying that administrative regulations may set special conditions. However, in fact, administrative regulations of the State Council have not, to date, set any additional access rules for engaging in trust business. This is an arbitrage space for the Trust Law and also one of the reasons that “targeted entrusted investment” has not been subjected to regulatory pressure to date.

Of course, broadly speaking, contract-based private equity funds fall within the scope of trust law, and it is not out of the realm of possibility for the CSRC, based on the principle of substance over form, to define targeted entrusted investment products as contract-based private equity funds and take regulatory measures in that respect.

Wu Weiming is a senior partner at AllBright Law Offices in Shanghai

上海市浦东新区银城中路501号

上海中心大厦11及12层 邮编:200120

11/F and 12/F, Shanghai Tower

No.501 Yincheng Middle Road

Pudong New Area, Shanghai 200120, China

电话 Tel: +86 21 2051 1000

传真 Fax: +86 21 2051 1999

电子信箱 E-mail:

wuweiming@allbrightlaw.com

www.allbrightlaw.com