Indian investors are sprinting eagerly towards attractive targets overseas, although they are taking more careful strides. A mix of economic uncertainty and a fear instilled by fractured deals are two important reasons Indian buyers are adopting a more calculated approach to outbound acquisitions and investments. Today, investors are exercising greater vigilance before signing on the dotted line.

“There’s far more due diligence going in,” says Sriram Chakravarthi, a partner in the India practice at Shook Lin & Bok in Singapore. “There have been a lot of horror stories … litigation and lots of arbitration that have come from going the cowboy way.”

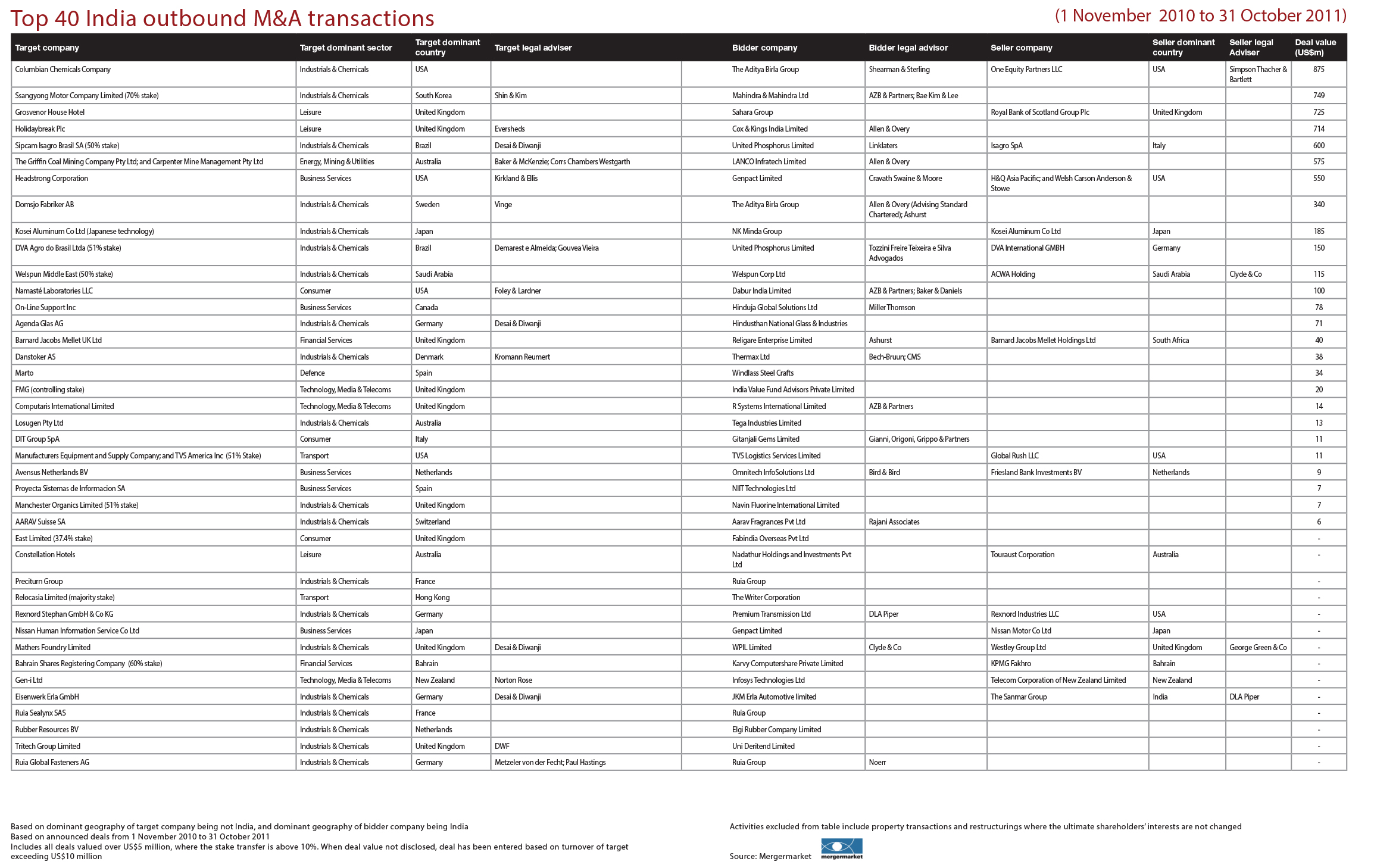

Companies have learned lessons from deals struck by large Indian businesses, many of which have produced lacklustre results. “None of the big deals over the past few years have really worked,” says Naina Krishnamurthy, the managing partner at Krishnamurthy & Co in Mumbai. “Investors are very wary anyway of making large investments abroad.”

You must be a

subscribersubscribersubscribersubscriber

to read this content, please

subscribesubscribesubscribesubscribe

today.

For group subscribers, please click here to access.

Interested in group subscription? Please contact us.