The profit compensation mechanism (PCM) for M&A transactions of listed companies does not seem to be producing the desired effect for which it was designed, as revealed by breaking news about overvaluation of targets, sharp performance declines upon deal closing, and inability to deliver on the profit compensation commitment. This article provides insight into problems with the PCM, and proposes capitalization of reserves as an approach to distributing post-M&A excess profit.

GONG RUOZHOU

国枫律师事务所律师

Associate

Grandway Law Offices

Problems with existing PCM. Being an essential part of an M&A programme, the PCM is ultimately aimed at achieving a win-win outcome between the listed company and the target in the long run. In the medium term, it is designed to prevent damage to interests of the listed company and its (small and medium) investors. However, direct profit compensation seems to fail in both objectives. As the ultimate objective is concerned, instead of helping to achieve a long-term win-win outcome, the mechanism brings only short-term interests, whether the compensation is provided in the form of bonus share or cash.

Worse still, it sets the scene for potential confrontation between the two sides at the very beginning of the deal process. As the medium-term objective is concerned, interests of the listed company and its (small and medium) investors cannot escape damage even if the existing PCM is enforced to the fullest extent. Let’s see how this mechanism works with a simplified algorithm using the formula for share-based compensation encouraged by regulators and earnings per share (EPS), a frequently mentioned indicator of investor protection.

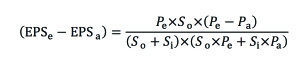

Assume that So represents the total number of existing shares of the listed company and Si the number of shares that it issues for the purpose of acquiring the target; Pe represents the profit promised by the target and Pa the realized profit. Without taking into account the listed company’s own earnings, EPSe=Pe/(So +Si); after providing share-based compensation, the counterparties hold shares that are computed as Sr=Si×Pa/Pe, translating into EPSa=Pa/(So +Sr) . Hence:

The lowercase letters “o” means original, “i” incremental, “e” expected, “a” actual, and “r” remaining.

Except Pa, all other parameters in the formula are positive figures at any time. Pe is higher than Pa, and (EPSe-EPSa) is above zero at any time. In other words, if the promised target profit is not generated, the expected rate of return based on the expected EPS cannot be achieved, even if share-based compensation is provided.

The advantages and feasibility of capitalization of reserves as an incentive mechanism. We can rarely find M&A cases where a mechanism is designed to enable both listed companies and their counterparties to benefit from future growth. As a matter of fact, the counterparties (i.e., the existing shareholders of the targets) are often founders of the targets, or have deep industry experience. It is very likely that it is their experience, capabilities and resources that the listing companies are seeking through the deals. Therefore, the listed companies should focus more on enabling both sides to benefit from future growth, thus indirectly achieving the objective of driving long-term development of the targets.

Based on this analysis, we propose capitalization of reserves as an incentive mechanism. Here’s how it may work: a series of more rational (that is, relatively lower) earnings forecasts are used to price the M&A transaction, for which specific conditions for distributing excess profit as incentive are specified. Once the conditions are met, the listed company will distribute the excess profit to counterparties through capitalization of reserves, which may be executed in phases. The calculation method for each phase may be adjusted in line with the prevailing share price, overall earnings profile of the listed company, and any other factors pre-approved by the general meeting.

Using capitalization of reserves provides the following benefits. (1) Substantial increase in goodwill upon closing of the deal can be avoided. At a conservative estimate, distributing excess profit as an incentive through capitalization of reserves will not lead to a rise in goodwill upon transaction, because the incentive does not form part of the direct costs of the M&A, nor is it an indirect cost that is very likely to incur in the future with an impact that can be reliably measured. (2) Individual income tax can be avoided. If the counterparties are natural persons and the bonus shares issued to the counterparties have resulted from capitalization of capital reserves arising from share offering at a premium by the listed company, then no individual income tax is payable on incomes of this sort. (3) The lock-up period mechanism will work more effectively. According to regulatory policies in effect, a lock-up period applies to M&A deals structured in such a manner that new issued shares are provided in exchange for the acquired assets. Actually, counterparties are able to liquidate their shares and exit early by creating a pledge over their shares. If capitalization of reserves is used, the returns that counterparties may expect from early liquidation and exit will be meaningfully reduced.

But there are also several issues which users of this mechanism need to take care of: (1) Capitalization involving statutory reserves, if any, must comply with restrictions under the Company Law as to the percentage of statutory reserves being used; (2) As one of the approaches to increasing registered capital of companies, the capitalization must be approved by the general meeting with a special resolution; (3) For the sake of protecting small and medium investors, the independent director should be asked to provide independent comments on matters relating to capitalization of reserves as an incentive mechanism, and votes of small and medium investors for these matters should be counted separately at the general meeting.

Historically, as a way of using company reserves permitted by law, capitalization of reserves was commonly used to pay for share purchase in the era of non-tradable share reform in China’s capital market. Although today capitalization of reserves is not as commonly used by listed companies, we believe that discussing this mechanism and giving it a try will be positive for the market-oriented reforms in China. Of course, implementation of this mechanism will depend on many factors, including regulatory policies, market environment, and willingness of parties to the transactions.

Gong Ruozhou is an associate at Grandway Law Offices

北京市东城区建国门内大街26号

新闻大厦7层 邮编:100005

7/F, Beijing News Plaza

No. 26 Jianguomennei Dajie

Beijing 100005, China

电话 Tel: +86 10 8800 4488 / 6609 0088

传真 Fax: +86 10 6609 0016

电子信箱 E-mail:

gongruozhou@grandwaylaw.com