International companies risk being entangled in India’s tax net, even if their investments have been structured offshore. Pranay Bhatia and Aditi Sharma examine the situation and reveal how the rules may be changing

International companies looking to invest in India often do so through mergers and acquisitions. Recently some of these acquisitions – like that by Vodafone of Hutchison’s telecom assets in India – have been caught up in tax controversies.

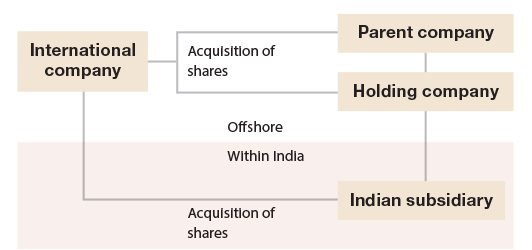

Choice of routes for transfer of shares

At the root of these controversies is the avenue taken by these companies. For while some international companies acquire shares within India, through an Indian subsidiary, others do so by buying into an offshore parent company or holding company that in turn owns shares within the country (see diagram A, page 44).

And it is the latter route that has run into controversies: India’s tax authorities claim that capital gains arising from offshore transactions are liable to be taxed in India.

You must be a

subscribersubscribersubscribersubscriber

to read this content, please

subscribesubscribesubscribesubscribe

today.

For group subscribers, please click here to access.

Interested in group subscription? Please contact us.

你需要登录去解锁本文内容。欢迎注册账号。如果想阅读月刊所有文章,欢迎成为我们的订阅会员成为我们的订阅会员。

Pranay Bhatia is an associate partner and Aditi Sharma is an associate at Economic Laws Practice in Mumbai.