M&A in China may be fraught with regulatory uncertainty, but a growing middle class might just provide the magic needed for foreign investment, writes Richard Li

It really is a foreign investor’s dream. China, once dubbed the factory of the world, is beginning to reap the rewards from decades of hard work, and now has a middle class of staggering proportions, which is intent on purchasing all the iconic items that go with this classification. Savvy foreign outfits are in the market for acquisitions to upgrade production lines of consumables, or simply to make their own stamp on a popular new subsector.

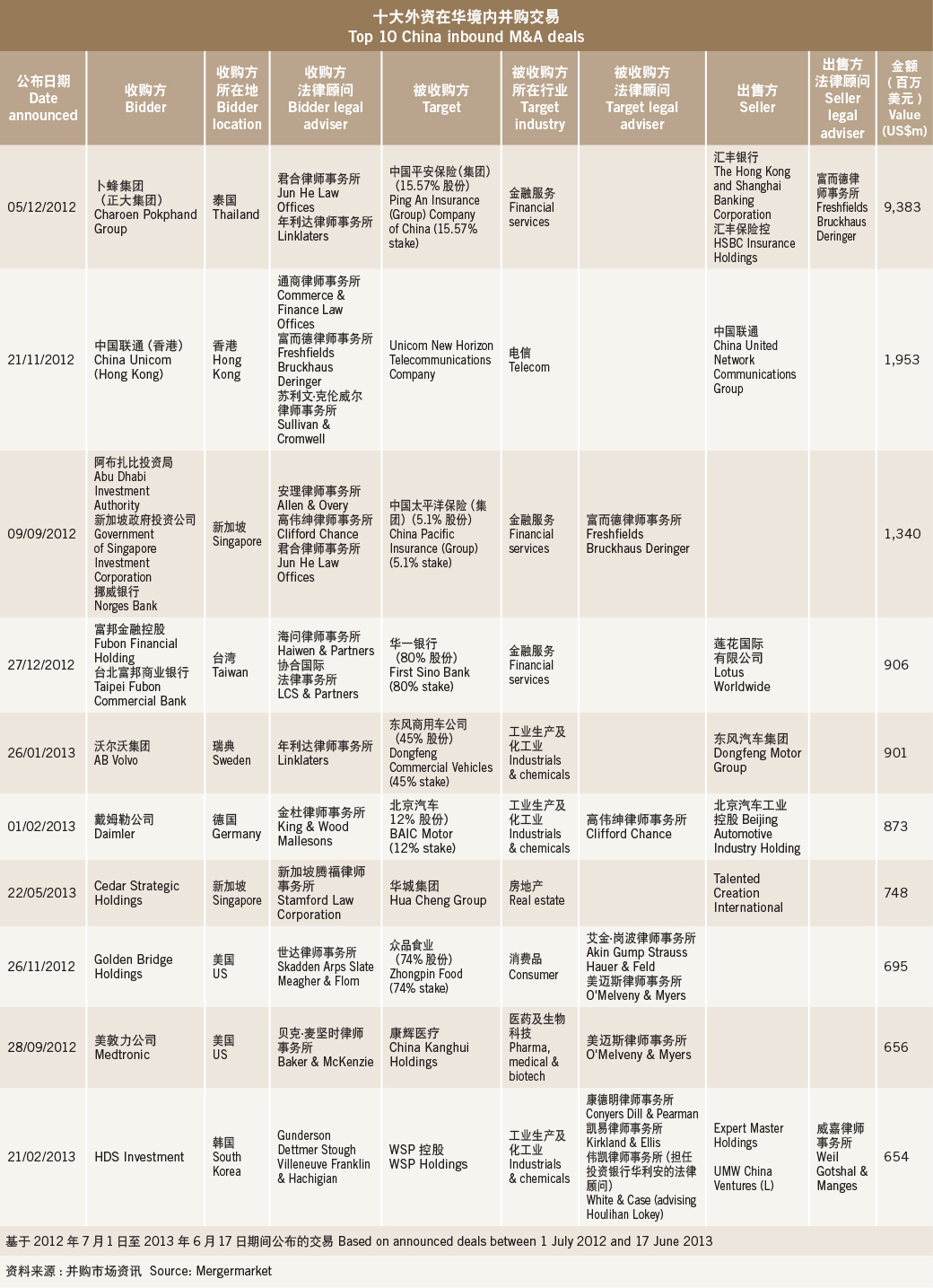

Health services, property and education are all legitimate targets, while e-commerce, telecommunications services and even the burgeoning movie and cinema industry are among other sectors that have attracted overseas M&A interest.

You must be a

subscribersubscribersubscribersubscriber

to read this content, please

subscribesubscribesubscribesubscribe

today.

For group subscribers, please click here to access.

Interested in group subscription? Please contact us.