Few international brands will have had as long an alliance with

India as Cartier

The renowned French jeweller has what it calls an “inspiring relationship” with India that dates back to 1911 when Jacques Cartier, a son of the founder, travelled to India and returned with precious stones and “a wealth of inspiring creative ideas”.

As India Business Law Journal goes to press, many of the people who could answer this question will be preparing to travel to Orlando, Florida, to attend the 138th annual meeting of the International Trademark Association (INTA). India Business Law Journal will be there too, and this IP-themed issue will be circulating widely among delegates.

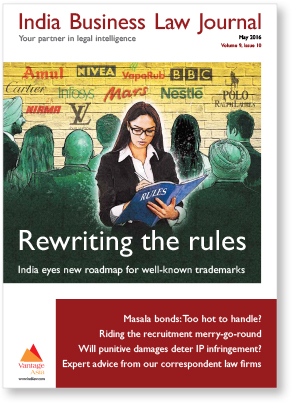

In our Cover story, we take a critical look at the challenges of obtaining well-known mark status in India. Many rights owners strive for this extra layer of protection, but as our coverage illustrates, all is not plain sailing. India’s intellectual property office maintains a list of well-known marks, but many observers complain that this in not comprehensive and that the process through which the list is compiled lacks transparency.

Rights owners are rightly frustrated. A case in point is Godrej Industries, which owns two trademarks that courts have recognized as well-known, but are not on the registry’s list. The company has met nothing but inertia in its dealings with the registry’s staff and Mandar Chandrachud, its general manager and head of IP, can do little to mask his exasperation: “The people are moving, but the file is not moving,” he says.

In The tides turn we shine the spotlight on punitive damages, which have been awarded for over a decade by courts in India but have done little to deter infringers. Until now this has been because punitive damages have been awarded against defendants who do not show up in court and the amounts awarded have been small. But this may be changing with at least one court – Delhi High Court – beginning to award damages that are large enough to make it worthwhile for the plaintiff to go after the infringer. “The legal system is changing and maturing to the extent where there will be actual litigation, actual costs, and actual damages,” says Chander Lall, founding partner of Singh & Singh Lall & Sethi.

Writing in this month’s Vantage point Pravin Anand, the managing partner of Anand and Anand, argues that the filing of writ petitions has radically changed the administration of intellectual property law in India. This powerful tool was recently used by affected parties when the Trade Marks Registry decided to abandon almost 200,000 trademark applications. Shocked applicants told Delhi High Court that this was contrary to the provisions of India’s trademark law and a judge, convinced of the prima facie arguments raised in the writ petitions, passed an order staying the abandonment. As Anand, who is arguably India’s best-known intellectual property lawyer, writes, writ jurisdiction enables courts to ensure that the rule of law permeates all state actions.

Moving away from intellectual property, in Too hot to handle? we focus on the new buzzword in the world of debt capital markets: masala bonds. These Indian rupee denominated bonds, which are listed outside India, have created a new avenue for foreign investors to access Indian bond markets. But as it stands masala bonds are proving a touch too spicy for many investors’ appetites, largely because the foreign exchange rate risk is borne by the investors. This is a key concern given the fluctuations in currency markets and as a result the market for masala bond issues has not been as active as initially expected. It is yet to be seen whether investors will finally acquire a taste for masala bonds once market uncertainty subsides.

This month’s Intelligence report provides an in-depth look at the recruitment and retention of lawyers in India. The break-up of Amarchand Mangaldas early last year triggered seismic shifts in the recruitment market as both of the resulting firms embarked on hiring sprees of unprecedented scale. Meanwhile, a new breed of law firms is enticing senior lawyers away from many of the more established players. “We’ve never seen this kind of turmoil in the industry,” says Bithika Anand, the founder and CEO of Legal League Consulting. “We’ve seen disintegration among the top firms and that process won’t stop now.”

Among the winners of this recruitment merry-go-round are the burgeoning number of specialist legal recruitment firms. As is to be expected their service comes at a considerable price, but one that the law firms in question seem more than willing to pay. Is this a sign of a market that is maturing?

Next month our more observant readers will notice some changes to India Business Law Journal. We will be celebrating our ninth anniversary with a facelift. Like Cartier, we are inspired by India and we are working hard to ensure that our new look reflects this.