M&A insurance is a growth industry in Asia as corporate buyers wise up to the value of protetcion from transaction risks, writes James Kelly

Risky business is forecast to be big business for those offering mergers and acquisition (M&A) insurance across Asia this year. With private equity (PE) funds divesting mature assets, cashed-up Chinese conglomerates looking to diversify their portfolios, and the relaxation of foreign investment limits in India, insurance firms offering risk protection for M&A and cross-border transactions will be kept busy.

While countries in the region are at different levels of maturity, the consensus is that transaction risk insurance is increasingly part of the mix in M&A deals.

“Brokers and insurers have seen a significant increase in both requests for quotations and bound insured deals over the past three years,” says William Seccombe, who leads Jardine Lloyd Thompson’s M&A Transaction Risk Insurance business in Asia. “Part of the reason for this is following a general global trend, but the investment made by the insurance industry in Asia in terms of people, marketing and training has also led to greater awareness of the products and their application by both clients and their advisers.”

Once the domain of the financial investor, transaction risk insurance is now regularly used by strategic buyers, and has in many cases become a valuable differentiator in competitive auctions. “Our experience has been that once a client or their adviser has used transaction insurance once, it is likely that they will look at it on future deals as well,” says Seccombe. “Asia still has a way to go before use is at the same level as it is in Europe and Australia, but we are certainly seeing it move in the right direction.”

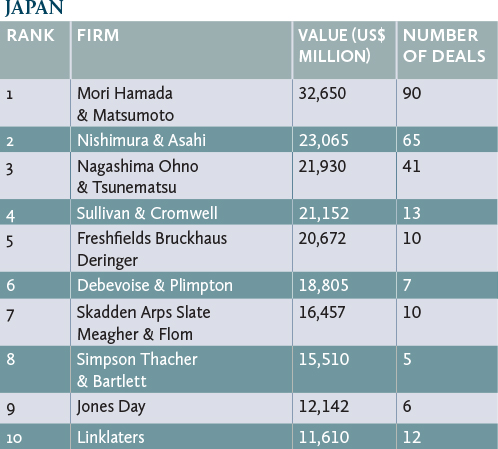

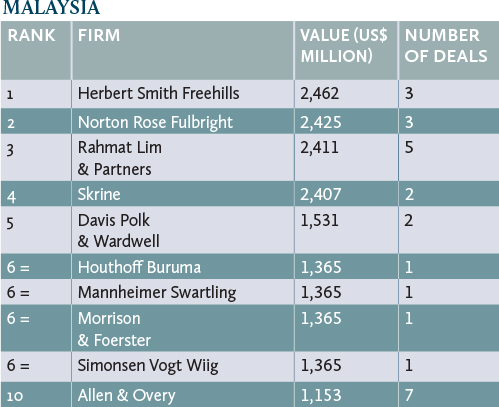

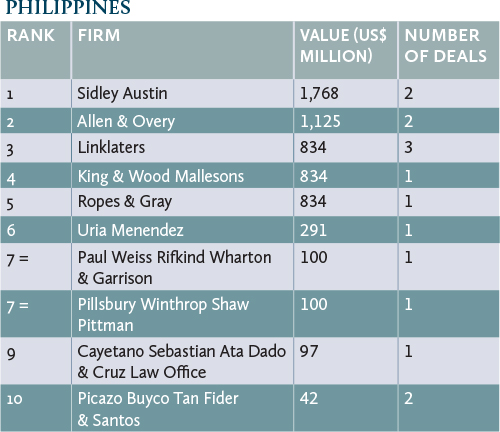

The key jurisdictions with significant deal flow in Asia are Hong Kong, Singapore, Japan and South Korea, although China, Malaysia and the Philippines are showing growth. As competition for assets increases, buyers are now looking elsewhere for corporate targets in unfamiliar jurisdictions.

“One of the things we are seeing is people looking to acquire a target company in a jurisdiction or sector where they haven’t been before, and that gives them an increased level of the unknown,” says AIG’s Hong Kong-based regional manager of M&A, Michael Turnbull. “But what they do have experience in doing is getting an insurance policy issued in their local jurisdiction that covers their normal day-to-day business risks. It’s quite a nice solution in terms of having an insurance product written by underwriters who understand the jurisdiction they are going into. So, for example for China, Malaysia or Indonesia you may have a policy written out of Hong Kong, together with your cyber risk policy or property policy, or whatever other policies you have. It’s something people are pretty comfortable with because they understand how those policies work.”

According to Turnbull: “M&A insurance can be really useful in navigating the way through things like concern around enforcement risk in overseas jurisdictions and the like. When parties enter into corporate M&A transactions there comes with that an element of the unknown and of risk, so when they complete the purchase of the company they are looking to buy they can sometimes find out that, despite their best efforts, and following what is quite a rigorous process, there are some unknown issues and some problems they hadn’t foreseen.”

William Lewis, head of M&A, Asia-Pacific, at Ironshore, says some clients choose to take out a product because of the financial strength of an insurer versus the counter party. “Another reason is that they are usually able to get a better position under the insurance policy than they would otherwise get under the SPA [sale and purchase agreement]. We always look for a fully negotiated sale and purchase agreement, but obviously when we are underwriting it we do take a view on some things, so often they might be able to get a warranty or indemnity covered that they might not have been able to get put into the sale and purchase agreement if they didn’t use insurance. And it does provide a clean exit to the vendor.”

Given the unique nature of each M&A transaction, the pricing of these bespoke policies is more art than science. “Trying to price things on an actuarial basis is a bit more tricky,” says Turnbull. “So if you think about a transaction where you’ve got a Chinese target being sold by a Hong Kong seller to a Singaporean buyer, you get some quite complicated dynamics. There are a number of things that we look at that would include what sector is the target operating in, is it one that we would consider to be more high-risk, and what’s the size of the deal, because there is an argument that on the larger-sized transactions your likelihood of getting a client can be higher. We would also look at who are the parties involved. We do have insureds who use this product as their way of doing deals, so if we’ve got repeat clients and we are familiar with the way they work their transactions, and the way their advisers work, then it will give us a good level of comfort as well.

“There’s a whole load of factors we would take into account outside the normal traditional insurance sense and then there are the other insurance factors that would come into play on any policy, like your excess or deductible level, and policy periods as well.”

As the number of policies issued has increased, so too have claims, typically relating to financial statements and tax-related issues. “Claims would come once the deal completes,” says Turnbull. “The policy is there to cover the unknown risks that, despite you having done your best due diligence, there are problems uncovered after the event.

“Confidentially stops us talking about deal-specific claims, but I can certainly confirm we are paying out millions of dollars each year on claims, and in many ways it’s a good thing, as it demonstrates the policies are working and that the products the insured are buying have real value.”

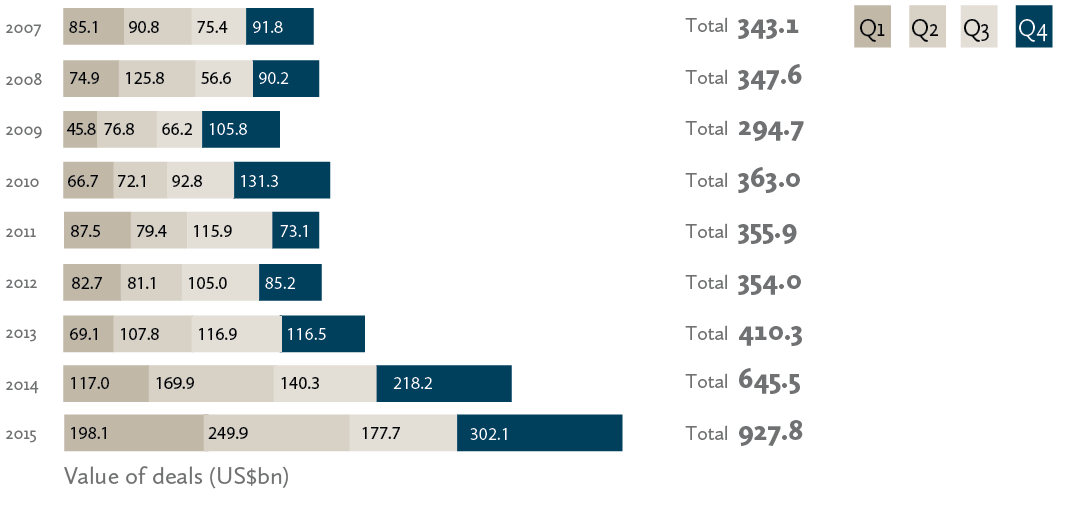

M&A quarterly activity (Asia-Pacific excluding Japan)

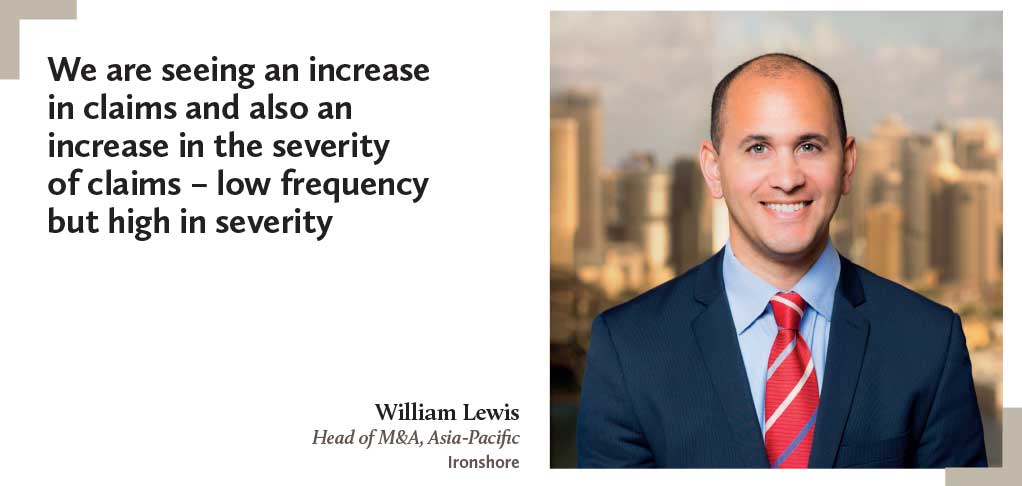

Ironshore reports a similar trend. “We are seeing an increase in claims and also an increase in the severity of claims – low frequency but high in severity,” says Lewis.

While the number of premiums issued is on the rise, so far this isn’t impacting pricing, notes Seccombe. “Global capacity now comfortably exceeds US$750 million, but local insurance regulations often limit how much of that capacity can be deployed in a particular jurisdiction. What has been relatively unusual compared to other classes of insurance business is that the availability of capacity has not driven the pricing down appreciably – it remains relatively stable with some industry segments even seeing minor premium increases.”

You can register for free register for free register for free register for free to enjoy selected content, including this article, or subscribe subscribe subscribe subscribe to unlock all content.

If you are already a registered user or subscriber, login here.

你可以免费注册去浏览这篇文章,你也可以订阅订阅去解锁所有内容。

如果你已经是我们的注册用户或者订阅会员,请在此登录:

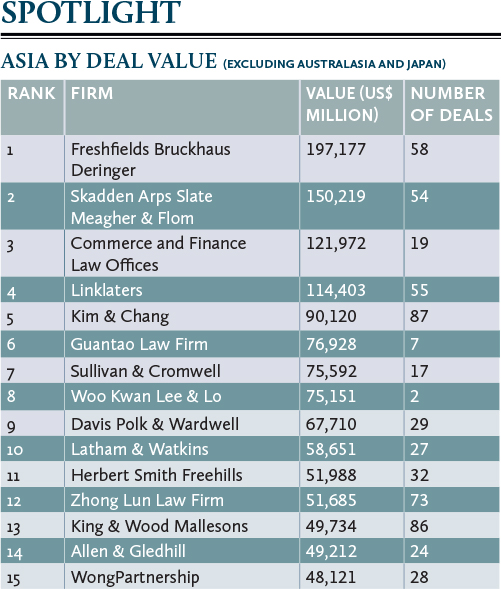

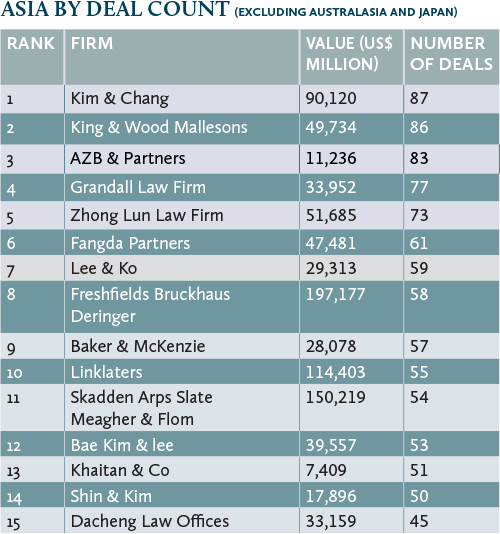

M&A by numbers

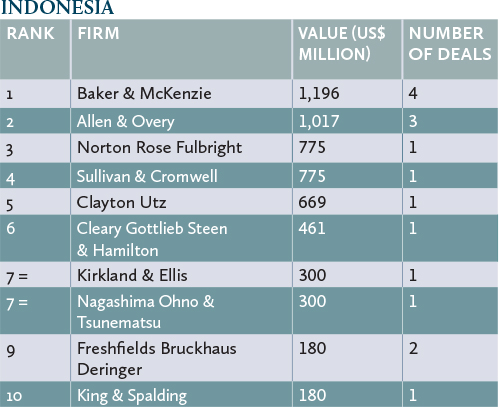

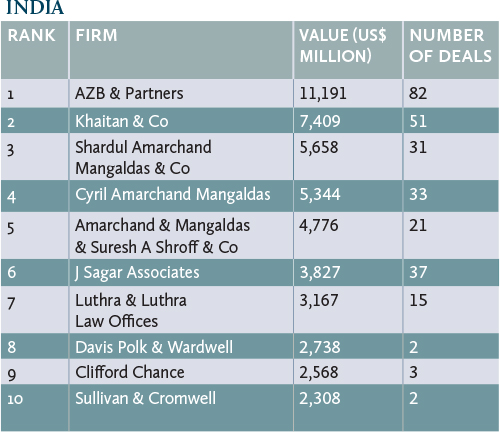

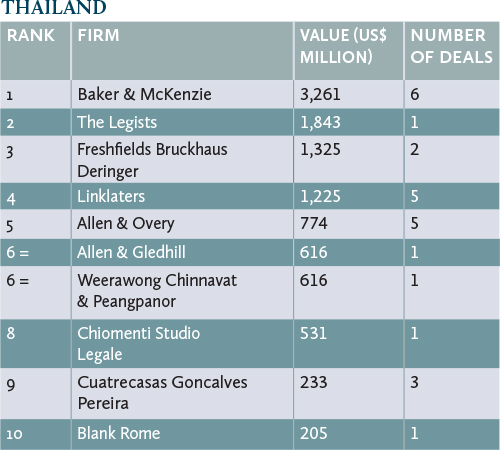

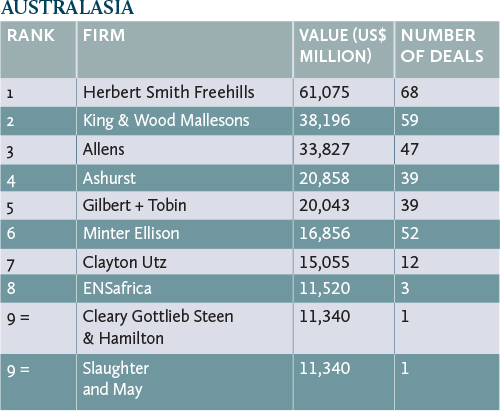

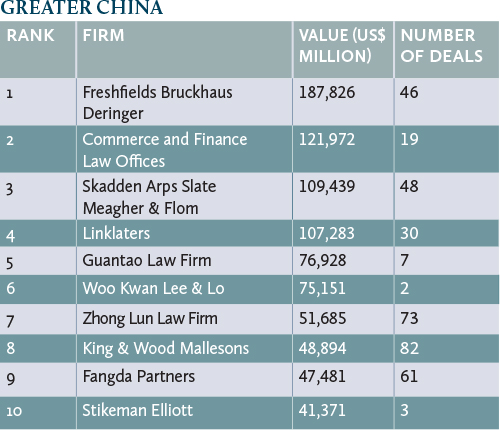

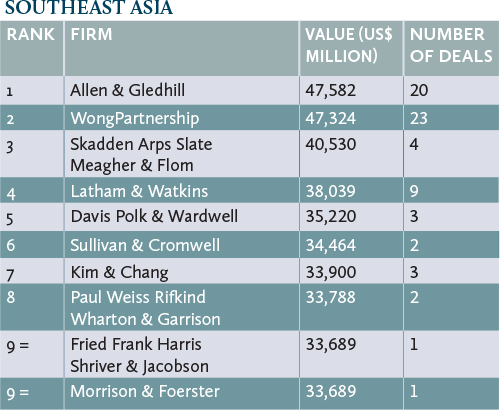

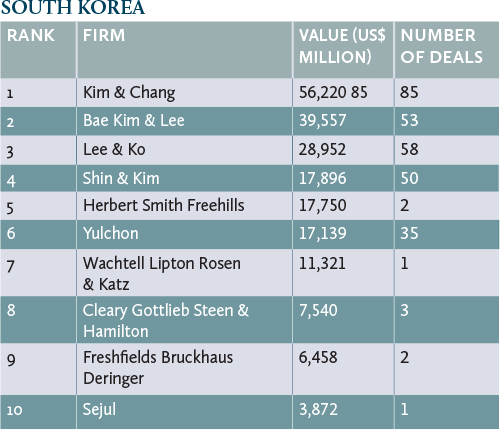

2015 announced deals by value (Top 10)