Q: What does the general procedure for private equity (PE) investment in energy and mineral resource projects involve?

Partner

AnJie Law Firm

Beijing

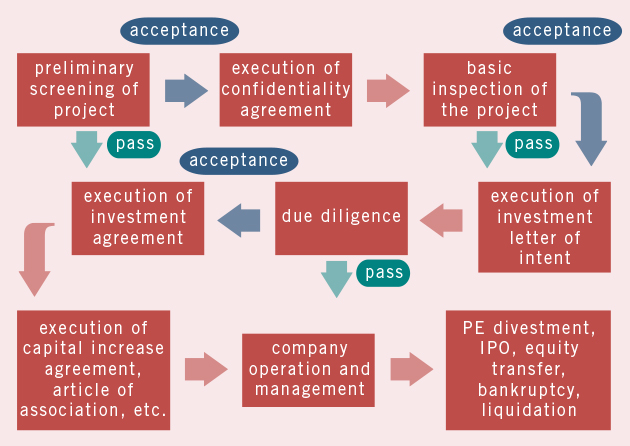

A: All different PE organisations have their own particular investment methods and means, however, in our legal service experience, the great majority of PE investments in energy and mineral resource projects take the form of equity investments, and the general procedure is illustrated at the bottom of this page.

If, in the course of the investment process, the inspection or investigation results at the preliminary screening, basic inspection of the project or due diligence stages are unsatisfactory, investment in the project may be foregone.

Partner

AnJie Law Firm

Beijing

Q: What are the legal risks involved in PE investments in energy and mineral resource projects?

A: The legal risks attending a PE investment in an energy or mineral resource project come from different quarters, and depending on the specific circumstances of different projects, the legal risks may also be different. However, generally speaking, there are six main kinds of legal risk:

- Target enterprise consolidation policy risks. At present, governmental authorities have, in respect of energy and mineral resource enterprises, and particularly mining enterprises, formulated consolidation policies based on the actual distribution of mineral resources. In areas where resource consolidation plans have been determined, the government will publicly announce entities that have been merged and restructured, mines that exist independently and mining enterprises that have been designated for consolidation, or separately release merger and restructuring qualification documents. Such a list of documents, or qualification documents, is the basis determining whether a mining enterprise can continue to exist independently. PE has to pay particular attention to such document lists or qualification documents, as the lawful continuation of a project is the fundamental precondition for an investment to be successful.

- Qualification risks. Based on China’s oversight policies for energy and mineral resource enterprises, such enterprises generally need to secure special qualifications and obtain relevant permits and licences. If a target enterprise does not have all of the required permits and licences, an investment would be defective and likely to leave latent hazards to future operation and management, and the choice of the manner of PE divestment.

- Land use rights risks. Land use rights are one of the key assets of energy and mineral resource enterprises, and the question of whether the target enterprise can secure lawful, valid and complete land use rights is key to the stability of the investment. PE needs to clearly verify title to the land use rights of the target enterprise and ascertain by what method the target enterprise obtained its land use rights. In practice, numerous enterprises secured their land by way of a lease and do not own the land use rights. Accordingly, it is impossible to carry out the procedures for a title certificate for the structures constructed on the land.

- Debt risks. If the target enterprise is relatively small in size, such enterprises often do not have a sound financial system, making it difficult for PE to determine how much in debt the target enterprise actually is. In such a case, a professional firm, such as an accounting firm or auditing firm, should be engaged to verify the situation and, in the investment agreement, the target enterprise should be required to assume a guarantee liability, or liability for breach of contract.

- Tax risks. If there are problems in the target enterprise’s payment of taxes, there is a possibility of pursuit for taxes after the PE investment, thereby shifting part of the legal risks onto PE. The main tax risks include: the pursuit of back taxes in connection with the transfer, during the supervision period, of the target enterprise’s equipment imported tax and duty free; tax evasion by the target enterprise; the target enterprise being in arrears in the payment of taxes or late payment fines, etc. To protect itself, PE can engage a professional intermediary firm to conduct due diligence to verify the matter and, in the investment agreement, require the target enterprise to assume the tax liabilities incurred before the PE investment.

- Labor employment risks. PRC policies and laws are putting increasing emphasis on, and continuously intensifying oversight of, the issue of the use of labour by energy and mineral resource enterprises, and accordingly, when investing, PE should also pay close attention to this issue. Risks associated with the use of labour are mainly manifested in the following ways: failure to execute employment contracts with employees; owing of overtime and wages to employees; failure to pay in full social insurance premiums for employees, etc.

Zheng Xilin and Chen Bin are partners at AnJie Law Firm in Beijing

北京市朝阳区建国门外大街甲6号

中环世贸中心D座26层

26/F, Tower D, Central International Trade Center

6A Jianguomenwai Avenue

Chaoyang District, Beijing, China

邮编 Postal code: 100022

电话 Tel: +86 10 8567 5988

传真 Fax: +86 10 8567 5999

www.anjielaw.com

电子信箱 E-mail:

zhengxilin@anjielaw.com

chenbin@anjielaw.com