Greek bonds may not seem much of a bargain at the moment, but that doesn’t mean investors view all things Greek with the same disdain. In fact, even as the eurozone crisis worsens, more and more Asian money is now looking for a home, not only in Greece, but across the whole of Europe, as both governments and businesses set out to sell assets to anyone with an eye for a bargain.

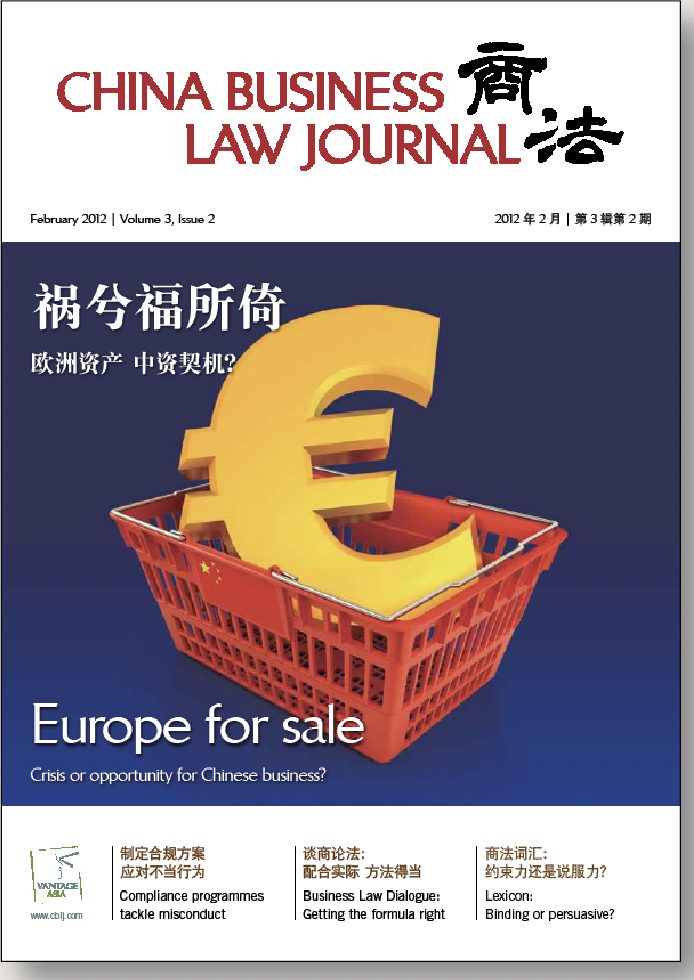

The other side of the eurozone coin is that the ever-higher mountain of sovereign debt is now creating an existential threat to the currency itself. With the Greeks and perhaps others flirting with default, there is a real possibility that one or more states may be forced out of the monetary union altogether. In the article Europe for sale, we explore the awkward question of how parties to different types of euro-denominated contracts might be affected by the disappearance of the euro as coin of the realm in those jurisdictions.

Our second story this month focuses on events closer to home. In her article, Paul Hasting’s Lesli Ligorner looks at how foreign multinationals operating in China often live to regret the lack of a comprehensive employment policy to protect them against actions by wayward employees dismissed for misconduct. Because the Chinese legal system offers a generally higher level of protection to employees than is normal in Western jurisdictions – especially if the employer is foreign – managers need to take additional steps to protect themselves. Corporate compliance programmes, workplace training that fully educates employees as to expected standards of conduct, and periodic risk assessments to establish a comprehensive compliance framework are all important steps managers should take to avoid the unwanted scenario of compensating an employee dismissed for corruption, bribery, or some other serious transgression.

In Getting the formula right, we speak to Philip Gu, a member of this magazine‘s editorial board and general counsel for the China subsidiary of French food and beverage manufacturer Danone. Mr Gu is a third-generation lawyer who guided the company through its lengthy legal dispute with former domestic partner Wahaha Group. He describes how the company’s small legal team deals with many issues, including handling the government’s increasingly strict food safety regime. We are grateful to him for sharing his thoughts.