Q: What are the typical post-investment disputes in China?

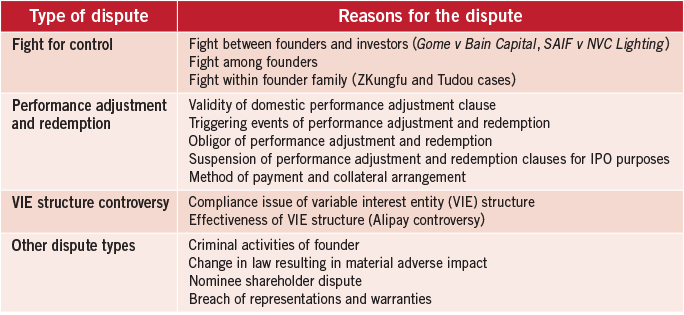

A: In our experience, post-investment disputes in China can be classified in the categories provided in the chart on the right.

Q: What are the reasons for disputes related to performance adjustment and redemption clauses, and how do you solve such disputes?

A: Disputes can arise with respect to the validity of performance adjustment and redemption clauses, and their implementation.

Jeremy Dai

安杰律师事务所

合伙人

Partner

AnJie Law Firm

In the Haifu Investment case, the Supreme Court upheld the validity of the performance adjustment clause between founders and investors, but nevertheless invalidated the same clause between the invested company and investors by citing potential negative harm to the interest of other shareholders and creditors. In reality, performance adjustment may not be implemented due to founders’ lack of sufficient assets. If a founder is required to gift transfer certain shares to investors, such a change in equity interest could cause an unstable shareholding structure in the company and negatively affect its IPO. In an onshore investment structure, investors are typically required to waive or suspend their performance adjustment rights pending the company’s A-share IPO. If the IPO does not go through, it remains uncertain whether the investors’ performance adjustment rights can be restored.

Redemption would typically be triggered in case of failure of a qualified IPO, or a material breach of definitive agreements by the company and/or the founders. A domestic company redemption, however, is subject to various restrictions under the Company Law and could face the burdensome procedures related to capital reduction. A founder redemption could be commercially unfair to the founder if the founder is required to redeem all the shares of the investors, given the fact that the founder only holds a certain percentage of shares in the company.

A redemption could also be affected if either the company or the founder does not have sufficient cash to finance the redemption. In such a case, investors may need to consider an instalment payment and collateral arrangements to secure such a redemption payment.

Q: What kind of risks would a foreign investor face under a VIE structure? How can such risks be avoided?

A: The primary risk for a variable interest entity (VIE) structure is its compliance issue, although the attitude of Chinese authorities remains vague at this stage. In practice, we have seen arbitration awards invalidating the enforceability of various control agreements under a VIE structure.

A VIE structure could also negatively affect the invested company’s IPO initiative. For the purposes of a Hong Kong IPO, Hong Kong Exchanges and Clearing (HKEx) has exercised much more stringent review standards towards a VIE structure IPO listing by adopting the HKEx listing decision. Rumours have spread that China’s securities watchdog, the China Securities Regulatory Commission (CSRC), may impose fresh approval requirements over offshore IPOs of applicants using a VIE structure.

George Zhang

安杰律师事务所

合伙人

Partner

AnJie Law Firm

A VIE structure may not guarantee foreign investors sufficient control over the domestic operating company. Under a VIE structure, typically investors do not have direct equity interest in a domestic operating company or the wholly foreign-owned enterprise (WFOE), and they are not legal representatives of these onshore companies, nor would they hold the company seal. Consequently they cannot prevent the founders from transferring key assets out of the domestic operating companies by breaching the VIE control agreements. The founders could also cause the domestic operating company to unilaterally terminate the VIE control agreements with the WFOE.

When considering a VIE structure, investors are advised to take into account the regulatory trend of the specific industry, and the future IPO plan of the invested company. Investors should also try to participate in the actual operation of the WFOE and the domestic operating companies by delegating certain trusted employees to serve as shareholders in the domestic operating company and retain veto power on certain important decisions that could affect the validity of the VIE control agreements.

Q: What are the key issues that foreign investors may face during an investment dispute proceeding?

A: A foreign investor could face the following dilemmas when dealing with an investment dispute, in particular a dispute involving a VIE structure:

Difficulty initiating an onshore lawsuit. Under PRC law, an investor could not cause the WFOE to sue either the domestic operating company or the founders, since it is not the legal representative and does not hold the company seal of the WFOE at the beginning of a dispute. In the past, we have witnessed several occasions where investors tried to use their control over the board of the WFOE as a weapon to outweigh the company seal of the WFOE controlled by the founder.

Difficulty enforcing a foreign award. Foreign investors typically prefer to choose a foreign governing law and foreign forum. However, even if the investors prevail in a foreign forum, the actual enforcement of such a foreign award can take a long time; sometimes it may be difficult to secure such enforcement in China.

In practice, we would typically recommend that foreign investors first retain control over the offshore holding company and the WFOE through an offshore proceeding (including the control over the authorised signatory of the WFOE, rights to appoint and remove the legal representative of the WFOE, and the right to retain the WFOE’s company seal), and then as a second step bring up a claim, even a criminal claim, against the founder and domestic operating company, so as to achieve the ultimate goal of protecting the investor’s legitimate interest.

Jeremy Dai and George Zhang are partners at AnJie Law Firm

京市朝阳区建国门外大街甲6号

中环世贸中心D座26层

26/F, Tower D, Central International Trade Center

6A Jianguomenwai Avenue

Chaoyang District, Beijing, China

邮编 Postal code: 100022

电话 Tel: +86 10 8567 5988

传真 Fax: +86 10 8567 5999

www.anjielaw.com

电子信箱 E-mail:

jeremydai@anjielaw.com

zhangjianzhou@anjielaw.com