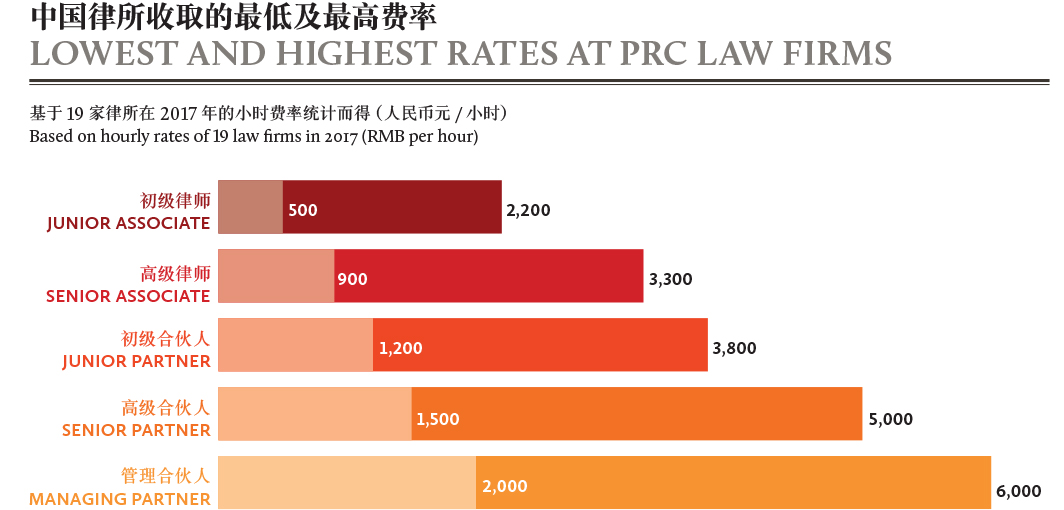

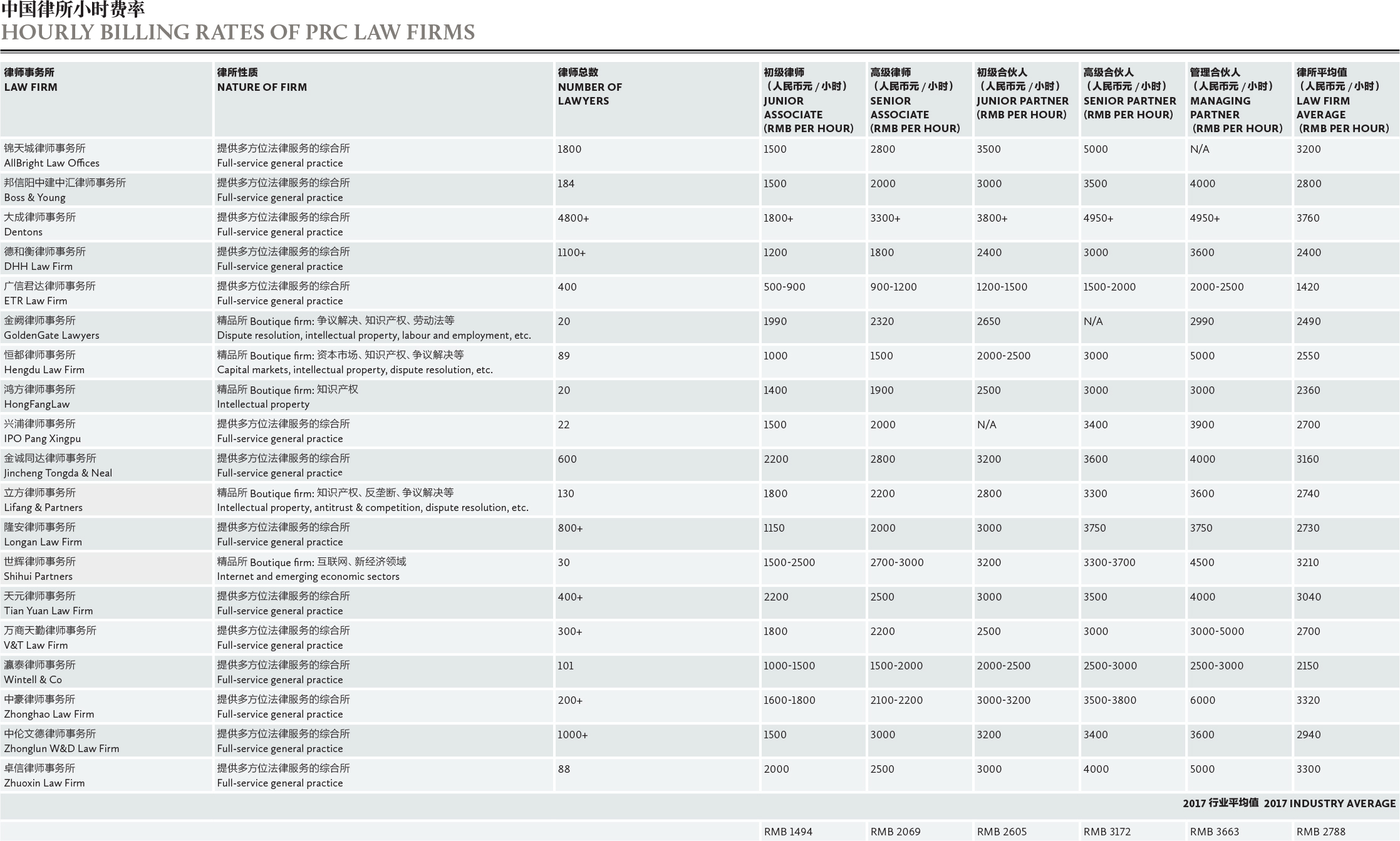

PRC law firms reveal their hourly billing rates for the first time in this unique report on legal fees, Vandana Chatlani reports

Disclaimer: All Chinese law firms were eligible to submit their billing rates for publication, there were no fees or any other requirements for participating. The billing rates shown in this report were provided by the participating law firms, and have not been verified by the publisher.

How much should you be paying for legal advice in China? The answer to this question of course depends on who you engage and what kind of advice you are seeking. But one thing is certain – navigating China’s complex and rapidly changing legal system requires diligence, intellect, creativity and a deep knowledge of national laws and the various ways they may be viewed by local governments, courts and businesses.

Partners at local Chinese law firms have said in the past that international lawyers would struggle to win assignments, particularly from state-owned companies, if they failed to offer more flexibility on legal fees. The situation is no different to India. In both jurisdictions, clients are exceptionally cost-conscious and firms quoting bargain prices often reign supreme.

In-house lawyers have become discerning, savvy buyers of legal services, with an increased awareness of how to secure value while also keeping costs low. They negotiate hard and demand fixed fees to keep a tight rein on their legal spending. The expansion and growing internationalization of Chinese firms through tie-ups with foreign partners also means that clients can enjoy domestic legal advice with a global outlook at attractive rates.

COST-CUTTING AND COMPETITION

As law firms in China jostle for a slice of the meatiest deals, they are often forced to come up with attractive fee quotes, much to the satisfaction of their clients. As Ye Qiuye, an in-house lawyer at CADFund in Beijing, says confidently: “There is no law firm that cannot be replaced. If your price is high, I’ll certainly be looking for someone else.”

The legal service market in China is more open than ever, says Paul Zhou, a partner at Wintell & Co in Shanghai. “Clients also have better knowledge of their legal service demands,” he says. “Law firms may need to lower their rates to drive revenue growth, improve marketing effectiveness and successfully compete against their rivals.”

But as Karen Ng, general counsel at Shui On Development in Shanghai, points out, the danger with undercutting is that it may result in a “lower quality of service provided to us”.

An Jun, the Beijing-based associate general counsel at Amazon China, says foreign firms may feel greater pressure as a result of price wars because a number of partners at local law firms have trained overseas. “They deliver pretty much the same quality at a much discounted price,” says An. “But ‘value for money’ is not my first priority when selecting law firms. I always want the best advice, and price consideration is secondary. Cutting prices to win clients does not work for me.”

You must be a

subscribersubscribersubscribersubscriber

to read this content, please

subscribesubscribesubscribesubscribe

today.

For group subscribers, please click here to access.

Interested in group subscription? Please contact us.

你需要登录去解锁本文内容。欢迎注册账号。如果想阅读月刊所有文章,欢迎成为我们的订阅会员成为我们的订阅会员。

What are the alternatives?

[/ihc-hide-content]