Differing real estate trends emblematic of India?

A recent bidding war for an office building in the heart of Mumbai’s business district, the Bandra Kurla Complex, that had earlier drawn lukewarm interest, points to the fact that not all real estate is in the doldrums. While the market for residential property continues its slump, with many thousands of square feet lying vacant, or worse, still unbuilt across India, it’s boom time for commercial real estate, where savvy investors within and outside India are chasing premium office space.

All of this is happening alongside increasing signs of a slowdown in the economy. Fortunes certainly appear to be varied, and investors recognize this. Is this further evidence of the fragmentation within the economy, such that boom and bust coexist within sectors but also across sectors and regions? What will this mean for the long-term growth and health of the economy and society as a whole?

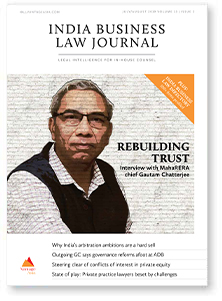

Discussing the role of the regulator and the challenges faced, Chatterjee says the fact that there are at least two other laws, including the Insolvency and Bankruptcy Code, 2016, that potentially deal with stressed projects “is not proving to be very healthy”.

The regulator deals with problems in the real estate sector such as declining trust among homebuyers, unsold inventory, and projects that are stuck. Yet as some homebuyers choose the National Company Law Tribunal to solve disputes with developers, it will take some time before the Real Estate Regulatory Authority can come into its own.

You must be a

subscribersubscribersubscribersubscriber

to read this content, please

subscribesubscribesubscribesubscribe

today.

For group subscribers, please click here to access.

Interested in group subscription? Please contact us.