In this column in the previous issue, this author focused on an exposition of the trends in the restructuring of offshore assets and the future plan of the China (Shanghai) Pilot Free Trade Zone (FTZ). At the end of the column, this author described one scheme for the restructuring and acquisition of offshore assets by listed companies. In this issue, the author will describe another two schemes for the restructuring and acquisition of offshore assets by listed companies.

Jonathan Sun

中银律师事务所

高级合伙人

Senior Partner

Zhong Yin Law Firm

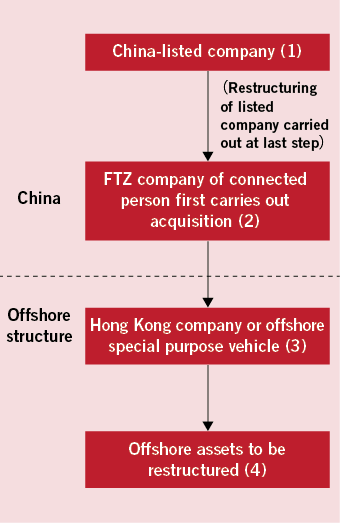

Scheme 2: China-listed company carries out a restructuring of offshore assets by way of restructuring a company previously acquired by a connected person.

In an offshore asset transaction, there is usually a bid invitation and submission procedure. In the bid undertaking, there is a major difference between the time of closing and the price of offshore assets, on the one hand, and the trading suspension time and transaction price required by the China Securities Regulatory Commission (CSRC), on the other hand.–

As shown in the graphic, the specific steps in the scheme are as follows: first, a connected person of the actual controller of the China-listed company establishes an FTZ company or establishes a company jointly established by the actual controller and an investment fund. Subsequently the company of the connected person effects the acquisition of the offshore assets by the standard procedure.

Once steps (2), (3) and (4) are completed, further compliance in law is carried out. Finally, an application is made to suspend trading of the listed company, and the board of directors and shareholders’ meeting procedures and the CSRC approval procedure are carried out.

Similar scheme

Similar to this scheme was the Anderson Services material asset restructuring scheme announced by Tong Oil Tools in June last year. On 7 April 2013, Zhang Guoan, the chairman of Tong Oil Tools, and his wife, Jiang Furong, established Huacheng Oil in Xi’an, one of the domestic investment entities for the contemplated offshore asset restructuring and acquisition, to serve as their domestic investment entity to participate in the contemplated joint acquisition.

Subsequently TPI, a US-based wholly owned subsidiary of Tong Oil Tools, established Tong Well Services. Next, Huacheng Oil in Xi’an established a wholly owned subsidiary in the US, Wellchase Energy, to serve as Huacheng Oil’s offshore acquisition platform, with both Wellchase Energy and TPI to contribute to an increase in the capital of Tong Well Services, whereupon they would respectively hold 60% and 40% of the equity of Tong Well Services after completion of the capital increase.

CSRC approval

The advantage of this structure is that, in terms of the approval by the CSRC, it is relatively reliable. Its disadvantage is the relatively large quantity of funds required at step (2), acquisition of the offshore assets; and if the CSRC’s restructuring committee momentarily suspends the approval procedure, the connected person’s company could face tremendous fund pressures.

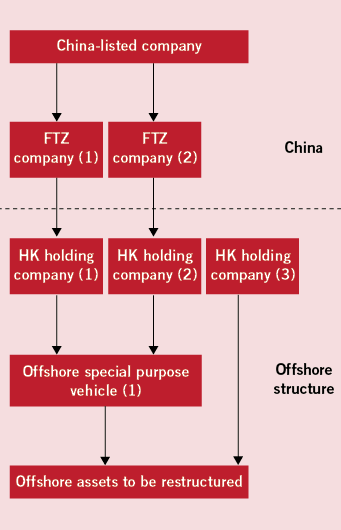

To avoid a delay arising in the CSRC’s approval procedure or the voting procedure in the shareholders’ general meeting of the China-listed company, scheme 3 designs a procedure that can be done in steps. The flowchart for the scheme is set out below:

The advantage of this scheme is that it avoids triggering the conditions for a listed company carrying out a material asset restructuring. The China-listed company first makes a cash acquisition of FTZ company (1) or restructures its shares, then in separate steps it gradually restructures FTZ company (2) and Hong Kong holding company (3). By proceeding in this manner it is possible to avoid, to a certain extent, the listed company being strapped for funds and the risk of uncertainty of CSRC approval.

This author will continue to explore other schemes in the next issue.

Jonathan Sun is a partner at Zhong Yin Law Firm

中国北京市朝阳区东三环中路39号

建外SOHO-A座31层

邮编: 100022

31 Floor, Jianwai SOHO A

Dongsanhuan Zhonglu 39, Chaoyang District

Beijing 100022, China

电话 Tel: 86 10 5869 8899

传真 Fax: 86 10 5869 9666

电子信箱 E-mail:

sunjian@zhongyinlawyer.com

www.zhongyinlawyer.com