American policymakers encourage foreign investment into the US, often with significant tax incentives, grants and other attractions. However, such transactions can be subject to a clearance review by the Committee on Foreign Investment in the US (CFIUS). The CFIUS is composed of representatives from multiple government agencies and departments, with the authority to analyse transactions “by or with any foreign person, which could result in control of a US business by a foreign person”. The committee’s purpose is to determine whether any such transaction might impair or potentially affect US national security interests.

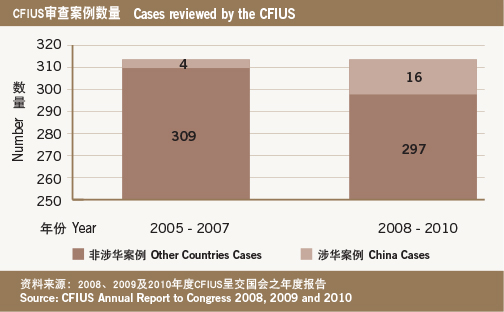

While the CFIUS does not target transactions from specific countries, it does engage in case-by-case reviews and considers all factors, which can include the investor’s country of origin. Due to the rapid rise of China’s economic and military capabilities, and record levels of investment in US assets, an increasing number of investments from China are likely to become subject to review. Statistical trends on recent CFIUS cases support this analysis:

The CFIUS operates under a broad and sometimes opaque scope in deciding which transactions fall within its jurisdiction. Certain transactions may more clearly be examined as implicating national security concerns (e.g. investments by foreign government-owned businesses, or transactions involving the transfer of military technology) while others are not as clear-cut.

You must be a

subscribersubscribersubscribersubscriber

to read this content, please

subscribesubscribesubscribesubscribe

today.

For group subscribers, please click here to access.

Interested in group subscription? Please contact us.

你需要登录去解锁本文内容。欢迎注册账号。如果想阅读月刊所有文章,欢迎成为我们的订阅会员成为我们的订阅会员。

Leodis Matthews is a senior partner at Dacheng Law Offices in Los Angeles. He can be contacted on +1 323 930 5690 or by email at leodis.matthews@dachenglaw.com. Xiao Ling is a partner at Dacheng Law Offices in New York. She can be contacted on +1 212 380 8388 or by email at xiao.ling@dachenglaw.com