When acquiring or merging with a Norwegian business, certain mandatory Norwegian regulations apply, such as merger and competition regulations. There is no general legislation in Norway applicable to foreign investments. Within some sectors there is special legislation on concessions, limitations on ownership, etc., in particular within the finance, media and energy sectors. In the first of two articles on this topic, we look at some of the most relevant merger and competition regulations, without looking at specific legislation for individual sectors of business. Next month, we will explore employees’ rights in connection with a transfer of business.

Partner

Wikborg Rein

Shanghai

The regulations

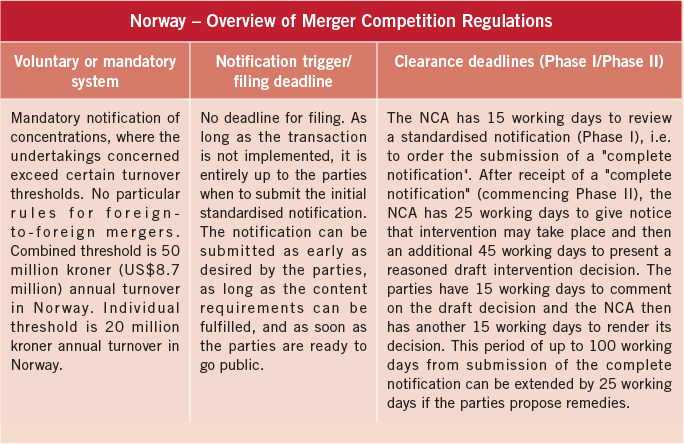

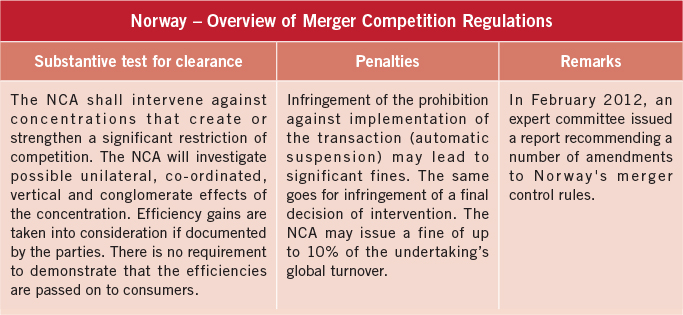

The relevant legislation for merger control in Norway is Chapter 4 of the Norwegian Competition Act of 5 March 2004 and the Regulation on Notification of Concentrations of 28 April 2004. The Norwegian Competition Authority (NCA) is the primary enforcer.

The merger control rules of the Norwegian Competition Act apply to “concentrations”. A concentration is deemed to arise where two or more previously independent undertakings, or parts of undertakings, merge, or one or more persons already controlling one or more undertakings acquire direct or indirect control on a lasting basis of the whole or parts of one or more other undertakings. The creation of a joint venture performing on a lasting basis all the functions of an autonomous economic entity constitutes a concentration, and is therefore subject to the merger control rules of the act.

A concentration must be notified to the NCA if;

- At least two of the undertakings concerned have an annual turnover in Norway exceeding 20 million kroner (US$3.4 million); and

- The combined annual turnover in Norway of the undertakings concerned exceeds 50 million kroner.

The Competition Act contains a mandatory obligation to notify a concentration to the NCA, provided that the thresholds are met. If the turnover thresholds of the EU Merger Regulations are met, Norwegian competition authorities will not have the authority to review the merger and no notification is required in Norway.

In the case of mergers, the obligation to notify rests with the merging parties jointly. If two or more undertakings acquire joint control over one or more other undertakings, the obligation to notify rests with the acquiring undertakings jointly. If a single undertaking acquires control over one or more other undertakings, the obligation to notify rests with the acquiring undertaking. No filing fees are required.

Senior Partner

Wikborg Rein

Oslo

An automatic standstill rule applies to all concentrations that are subject to notification to the NCA. The NCA has granted a number of exemptions from the standstill obligation on a case-by-case basis. Several cases concern acquisitions where the target has been in financial difficulties and the value of the target business could be significantly diminished if the parties could not begin implementation prior to the NCA’s clearance. A specific regulation provides for an exemption for public takeover bids from the automatic standstill obligation.

The NCA has 15 working days to consider a standardised notification. This is often described as Phase I. If the NCA decides to investigate the transaction further, it will order the submission of a “complete notification”, which brings the case to Phase II. If the NCA does not impose such an obligation, the transaction is automatically considered cleared. Most transactions are cleared in Phase I as a result of the expiry of the initial 15 working days deadline. Less than 5% of the notified concentrations proceed to Phase II.

The NCA is obliged by law to protect business secrets and other confidential information. The NCA is required to publish some basic information about every notification on its website. A proposal for a public version of the notification, or a clear statement of which information in the notification is regarded by the notifying party (or parties) as business secrets, must be submitted at the same time as a notification.

Geir Sviggum is a partner at Wikborg Rein in Shanghai and Arne Didrik Kjørnæs is a senior partner at Wikborg Rein in Oslo

上海市卢湾区淮海中路300号

香港新世界大厦1902室

1902 Hong Kong New World Tower,

300 Huai Hai Middle Road, Shanghai

邮编 Postal code: 200021

电话 Tel: +86 21 6339 0101

传真 Fax: +86 21 6339 0606

电子信箱 E-mail:

gsv@wrco.com.cn

www.wr.no