In an offshore red-chip structure, staff typically participate in the employee incentive scheme of an offshore company aiming to list. Relevant competent authorities, including the State Administration of Foreign Exchange (SAFE), usually supervise the implementation of the employee incentive scheme. However, in recent years, with the continuing increase in the number of onshore companies achieving overseas listing with the use of a red-chip structure, the practice of implementing the employee incentive scheme in such a format through a trust plan has become mature.

Senior Partner

Dentons

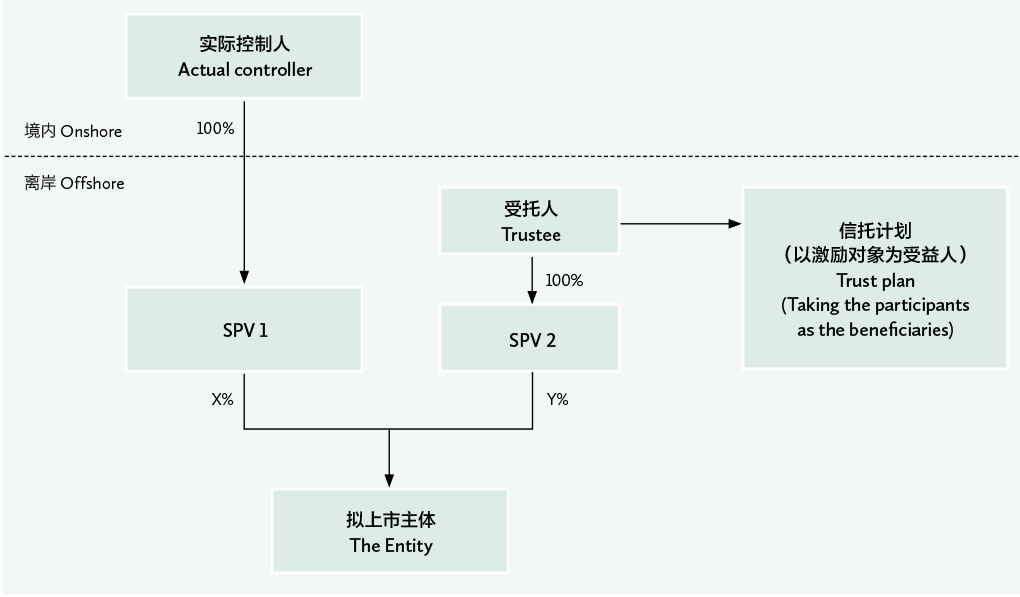

Generally, the trust is established in a way where the staff participate in the employee incentive scheme (hereafter referred to as “Participants”) as the beneficiaries of the trust and the overseas trustee (usually a trust company) will hold the shares issued by the offshore company seeking listing (hereafter referred to as the “Entity”) through a special-purpose vehicle (hereafter referred to as the “SPV”) under its ownership, so that it can hold the shares of the Entity through the SPV for the benefits of the Participants (please refer to the simple illustration of the trust arrangement structure in this column).

In practice, China Renaissance Holdings (CRH) adopted this structure. As shown in the application document, which CRH submitted to the Stock Exchange of Hong Kong (SEHK) on 25 June 2018, Infiniti Trust (Hong Kong) established the Sky Allies trust plan, placing itself as the trustee with the Participants as the beneficiaries, and through Sky Allies Development, which is under its outright ownership, it holds relevant shares of CRH by way of trust and for the benefit of the Participants.

The issues that generally need to be focused on while implementing the employee incentive scheme are listed as follows:

Tax planning. In accordance with relevant laws and regulations, employees obtain benefits through the exercise, and the tax shall be paid in accordance with the seven-level progressive taxation in excess of a specific amount as stated under the item of “income from wages and salaries”, the tax costs of which are relatively higher. Through trust, the income can be divided into different taxable categories in order to achieve reasonable tax avoidance. Of course, the feasibility in practice largely depends on the communication with, and confirmation of, competent tax authorities.

Registration of Document No.37. From the disclosed documents so far, for the employee incentive schemes implemented through a trust arrangement, most beneficiaries of the trust plan have not completed the registration under Document No.37. If such shares only account for a small part, they will not constitute a substantial risk of impediment to the overseas listing. Of course, the registration practice of Document No.37 varies in different regions. It largely depends on the actual operation of banks and SAFE.

Bringing forward the time that Participants actually enjoy the benefits. Compared with issuing the option directly to the domestic Participants by the Entity, implementing certain shares by way of trust may enable the Participants to obtain the dividends of the Entity as the beneficiaries of the trust plan before the exercise.

In conclusion, the employee incentive scheme in the offshore red-chip structure implemented through a trust arrangement has formed a relatively stable structure after years of practice, and has been increasingly popular to use. However, there may be some differences in practice between the requirements of relevant local authorities on taxation or registration of Document No.37. We suggest that, when designing and selecting the structure, the company should communicate with relevant authorities in advance to confirm the feasibility of the plan, so as to avoid any unnecessary risks that may arise.

Video is in Mandarin.

Jason Cheng is a senior partner at Dentons. Dentons’ associate Mao Shengdi and paralegal Jiang Hao also contributed to the article

上海市浦东新区银城中路501号

上海中心15/16层 邮编: 200120

15th/16th Floor, Shanghai Tower

501 Yincheng Road (M), Pudong New Area

Shanghai 200120, China

电话 Tel: +86 21 5878 5888

传真 Fax: +86 21 5878 6866

电子信箱 E-mail:

jason.cheng@dentons.cn

shengdi.mao@dentons.cn

hao.jiang@dentons.cn