Home Search

Search results: Companies Act

Guidance awaited on future of group of companies doctrine

Arbitration is a creature of contract statutorily backed by the Arbitration and Conciliation Act, 1996 (act), which is intended to provide quick and efficacious alternate dispute remedies. In our experience, challenging areas in arbitration...

Here comes the sun

With the worst of the pandemic behind us, and despite looming clouds in the global economy and geopolitics, India Business Law Journal’s annual market survey finds law firms in a buoyant mood on the...

Lending apps under RBI scrutiny

India’s digital lending industry, which is expected to grow in worth to USD1.3 trillion by the end of the decade, has been subject to a clampdown by the central bank. The Reserve Bank of...

Black & white

While the decision to update the competition act is commendable there are significant negatives, including the potential abuse of power, that lawyers say make the pending bill’s success anything but clear. Freny Patel reports

India’s...

Trilegal names Khaitan’s Jariwal as New Delhi disputes partner

Former Khaitan & Co lawyer Rajat Jariwal joins Trilegal as a partner in the disputes resolution team at the New Delhi office from this month.

“We expect him to play a crucial role in...

Digital lending goes up; RBI cracks down

India’s vibrant digital lending sector has grown at an unprecedented rate, increasing from USD9 billion in 2009 to USD110 billion a decade later. Participants in the industry include banks and financial institutions regulated by...

Stronger links stimulate Japan investment in India

In 2020-21, India attracted its highest-ever foreign direct investment (FDI) of USD81.97 billion, despite the disruption caused by the covid-19 pandemic. Indeed, according to a report released by the United Nations Conference on Trade...

India revises CSR impact assessment norms

The Ministry of Corporate Affairs has modified the guidelines for determining how much it costs to perform social impact evaluations for corporate social responsibility (CSR) activities, and the process for handling the unused CSR...

IBBI amends liquidation regulations

The Insolvency and Bankruptcy Board of India (IBBI) has made several major modifications to liquidation regulations, which came into effect on 6 September. The changes will ensure better stakeholder participation, cut back on delays...

Cyril Amarchand Mangaldas names ICICI Bank’s Jian Johnson as partner

Cyril Amarchand Mangaldas (CAM) names Jian Johnson as partner under its finance practice team and will report from the Mumbai office.

Johnson previously was the senior head of the corporate legal group at ICICI Bank,...

Regulators looking to rate ESG rating providers

Environmental social and governance (ESG) factors are increasingly important both globally and in India. ESG investments are now a separate investment class and private equity and venture capital investors often require ESG compliance by...

King & Spalding hires Morrison partner in London

Amit Kataria joins King & Spalding as a partner in the firm’s corporate, finance and investments (CFI) practice at the London office, and will also spend time at the New York branch.

Previously, he was...

Supreme Court decision clouds insolvency process

The Supreme Court’s judgment in the case of Vidarbha Industries Power v Axis Bank opened a Pandora’s box earlier this year when it unsettled a long established practice of the adjudicating authority admitting insolvency...

Phoenix Legal’s Vasanth Rajasekaran launches independent Trinity Chambers

Vasanth Rajasekaran, former equity partner at Phoenix Legal has established independent litigation practice Trinity Chambers, with his colleagues Saurabh Babulkar and Harshavardhan Korada.

Trinity Chambers founder Rajasekaran served as a partner for five years at...

Too much power?

Fears of raids and asset seizures have turned the Directorate of Enforcement into a veritable bogeyman for India inc, writes Freny Patel

T he Directorate of Enforcement (ED), India’s most powerful crime-fighting agency, makes daily...

IndusLaw, Cyril Amarchand and Talwar Thakore assist in Yulu bike app’s USD82m deal

IndusLaw advises urban mobility app Yulu in raising USD82 million from a series B investment led by US-based Magna International, which had Cyril Amarchand Mangaldas (CAM) as counsel.

The team at IndusLaw comprised senior partner...

Solving the problem of interest and insolvency

The component of interest has played a significant role in the admission of a company into insolvency where the required monetary threshold is partially unmet. The question that arises in these situations is whether...

Fox Mandal hires Trilegal’s Rohan Singh for Mumbai office

Rohan Singh has joined Fox Mandal & Associates as a partner under the firm’s corporate and M&A practice in Mumbai.

He had been counsel at Trilegal prior to this, while he previously worked at Nishith...

GST: A 5-year report card

A look back at the past five years shows that GST hasn't been the game-changer that was promised. Shivanand Pandit reports

Five action-packed years, 47 GST council meetings, manifold tax rates, and several boundaries set...

Argus, AZB, SAM and CAM advise on INR 7.75bn for EarlySalary

Argus Partners, AZB & Partners, Cyril Amarchand Mangaldas (CAM) and Shardul Amarchand Mangaldas (SAM) advised parties in the INR7.75 billion (USD79 million) raised in fresh funding for fintech firm EarlySalary.

Argus Partners assisted the existing...

DSK, CAM, Link Legal lead advisers in Imagicaa debt restructuring

DSK Legal, Cyril Amarchand Mangaldas (CAM) and Link Legal advised in India amusement park Imagicaaworld Entertainment’s debt restructuring that saw Malpani Group acquire a 66.5% stake in its rival.

Malpani’s acquisition in Imagicaaworld is valued...

Committee recommends recognition of stock appreciation rights

Soaring valuations and constant innovation have made the start-up landscape in India extremely competitive. Not only has this led to an increased demand for executive talent but it has also led to a more...

New electricity bill likely to spark controversy

The government has introduced the Electricity (Amendment) Bill, 2022 (new bill) to amend the Electricity Act, 2003 (act). A similar attempt in 2020 (2020 bill) was shelved following the farmers’ protests. The new bill...

E-invoicing threshold lowered

Businesses falling under the ambit of the goods and services tax (GST) with a turnover of INR100 million (USD1.2 million) are now required to generate e-invoices for their transactions starting 1 October 2022. The...

RBI perhaps too suspicious of digital lending

Consistent with its customer-protection orientation, and its hawkish stance towards the fintech sector, the Reserve Bank of India (RBI) set up a working group in January 2021 to evaluate “digital lending including lending through...

Court clears airport agreement for takeoff

In the recent case of MIHAN India Ltd v GMR Airports Ltd and Ors, the Supreme Court confirmed that no public body or authority may act in an arbitrary manner merely because it has...

India, Japan build an enterprising cyber future

In June 2022, India and Japan held a high-level virtual cyber dialogue. The joint secretary of the Cyber Diplomacy Division of the Ministry of External Affairs led the India side, which included ministries such...

Wipro hires OYO’s Tejal Patil as general counsel

OYO (Oravel Stays) senior legal adviser Tejal Patil has joined Wipro as the general counsel and senior vice-president. She has nearly three decades of experience in legal, governance and compliance across the Asia-Pacific region.

Patil...

Rules of engagement

There are two different rulebooks for dealing with anti-competitive behaviour around the world. Respected legal academic Souvik Chatterji analyses the differences from an India perspective and explains how one makes for quicker and more...

Court in the act

Supreme Court gives teeth to copyright penalties

The Supreme Court’s judgment in the recent matter of Knit Pro International v State of NCT of Delhi is likely to assuage the demands of Western nations that...

You’re hooked!

A new cyber scam is targeting top brands’ websites to sell fake dealerships and franchise offers. While the courts are helping by making such offences cognisable and non-bailable, brand owners must up the ante...

M&E head Anushree Rauta made equity partner at ANM Global

ANM Global has promoted Anushree Rauta, head of its media and entertainment practice, to equity partnership at the firm. She joined the law firm in 2018 and has helped ANM Global to become one...

Bouncing back

As business and travel edge back to normal after the pandemic, which foreign law firms are leading the field with their India offerings? Vandana Chatlani finds out

See earlier editions of this report

F

ollowing a swift...

Granting employee stock options to promoters

Companies cannot grant employee stock options (ESOPs) to promoters under Indian law. This restriction is set out in rule 12 of the Companies (Issue of Share Capital and Debenture) Rules, 2014 (rules) and Regulation...

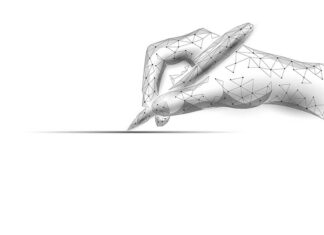

The write moment

For 20 years, e-signatures and the transformation to paperless offices were dangled as the promises of a brave new world that remained, well, on paper. Now a tectonic shift is underway. Georgy Thomas reports

From...

Employee secondment becomes taxing for Japanese companies

Japanese multinational companies often second their nationals to connected companies in different jurisdictions. The group learns about internal cultural differences, employees gain valuable experience and relationships are strengthened within the group.

In a secondment, the...

Startup founders face reclassification dilemma

The startup ecosystem has grown steadily over the past few years, raising a record USD42 billion for more than 1,500 deals in 2021 alone. Raising debt is expensive, and often impossible, for most startups,...

Well-known trademarks – a growing reality

It has not been easy for a trademark to be recognised as a well-known trademark. However, with changing perceptions, expanding globalisation and consumers becoming more brand-conscious, a shift is happening. Courts are no longer...

Key challenges ahead for new related party regime

Related party transactions (RPT) have always remained a key monitoring agenda for regulators, given the nuances in how it is used for the personal gains of people in control. The revised RPT regime brought...

RBI takes credit for curbing PPI financing

On June 20, 2022, the Reserve Bank of India (RBI) issued directions to all non-bank prepaid payment instrument (PPI) issuers that loading of PPIs through credit lines was not permitted (PPI credit circular). This...

Companies depend on proper paperwork at trial

As companies come into existence only through statute, and their powers and those of their officers are similarly derived, documents and their proofs are vital when companies are involved in litigation. It is essential...

Energy open access gets the green light

To further speed up India’s mission of achieving half its installed power capacity through non-fossil fuels by 2030, the Ministry of Power (MoP) by its notification of 6 June 2022, introduced the Electricity (Promoting...

Jayashree Dasgupta quits Dhir & Dhir to launch independent litigation chambers

Dhir & Dhir Associates’ partner Jayashree Dasgupta has left the firm after serving an 18-year career to open her own independent litigation chambers in South Delhi. She currently has two lawyers, with other appointments...

Condition critical

A conflict has played out before several judicial forums over the fate of Future Retail, a company in grave health with creditors and two of the world’s richest men entangled in its fate. Freny...

Indiagold names Mini Gautam as legal head

Gold-focused digital alternative credit platform Indiagold has appointed Mini Gautam as the company’s legal head and general counsel. She is the founder and managing partner of Arthavat Law Offices, providing legal as well as...

Adani takes over Holcim’s India business for USD10.5bn

Adani Group has acquired Switzerland-based Holcim’s entire stake in India’s two leading cement companies, Ambuja Cements and ACC, through an offshore special purpose vehicle amounting to USD10.5 billion.

Cyril Amarchand Mangaldas & Co (CAM) acted...

L&L Partners dissolves litigation arm; hires Verus’ founding partner

L&L Partners’ managing partner Rajiv Luthra has issued a notice for the dissolution of the firm’s litigation arm and chalked out a plan to reorganise its various practice areas under a one-firm structure.

As a...

Fintech firm Kissht secures USD80mn in funding boost

Vertex Growth and the government-owned corporation, Brunei Investment Agency, were lead investors in consumer lending fintech firm Kissht raising USD80 million in fresh funding. IndusLaw and Cyril Amarchand Mangaldas were advisers in the deal.

The...

Departing IT staff getting tied up with non-compete clauses

Shortage of tech talent across all industries is taking a particularly huge toll on information technology companies as digital ecosystems evolve and adapt to repercussions of the pandemic – with many IT employees offered...

Private equity investment in P2P solar trading

India’s solar energy ecosystem is rapidly developing. A recent phenomenon is the peer-to-peer (P2P) trading of solar energy, where persons generating solar energy for their private use are selling excess power generated to other...

Swain leaves HSA to resume operations at DLS

Dipti Lavya Swain, a partner at HSA Advocates in New Delhi, is resuming his independent practice, DLS Law Offices – the firm whose New Delhi and Mumbai offices he had merged with HSA.

DLS started...

Strength during adversity

Enduring challenges amid a perfect storm

The country is in the midst of grappling with unfavourable circumstances such as high unemployment and high inflation. Together these can potentially become as disruptive as the pandemic, but...

Policy for mined out coal lands approved

The federal cabinet has approved a policy for acquiring land parcels that are mined out or unsuitable for coal mining purposes to increase investment and create job opportunities in the coal sector.

The land-use policy...

RBI increases responsibilities of loan transfer parties

The Reserve Bank of India (RBI) issued the Transfer of Loan Exposures Directions, 2021 (directions) in September 2021, which prescribe a comprehensive and robust framework to facilitate the sale, transfer and acquisition of loan...

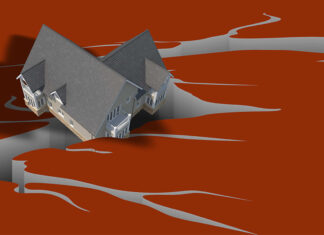

Shaky ground

A spate of defaults at several prominent real estate companies has left creditors and homeowners on shaky ground, with several challenges awaiting them at the insolvency court, writes Vineeta Bansal

When Supertech, one of the...

Price of protection

India's proposed data protection regulation demands data localisation and restricts cross-border transfers, promising economic benefits for the broader economy, but imposing big cost and logistical challenges on Indian and international companies, write K Satish...

Comply with AI

The automation of compliance processes can keep companies up to date with a constantly evolving regulatory environment and out of trouble with the law, writes MP Birla Group’s Subhadeep Bhowmik.

Adhering to statutory compliance is...

Eyes wide shut

The decision to exempt mergers below certain thresholds from the CCI’s gaze has starkly divided opinions among competition lawyers, writes Freny Patel

A lot is riding on the government extending the de minimis exemption benefit...

Who dares wins, but not at our expense

To align the regulatory framework for non-banking financial companies (NBFCs) with mainstream governance practices, the Reserve Bank of India (RBI) introduced a scale-based regulatory framework for NBFCs in October 2021. This included governance-related requirements.

The...

Ignoring precedent risks stability in real estate

The concept of precedent and the binding effect of precedents set by higher courts on lower courts is one of the cardinal bases on which the judiciary functions and the doctrine of stare decisis...

Pricing dilemma in acquisitions by foreign owned companies

Rule 23(1) of the Foreign Exchange Management (Non-Debt Instruments) Rules 2019 (rules) provides that investments by foreign-owned or controlled companies (FOCC) in an Indian company shall be subject to “entry route, sectoral caps, pricing...

Indian Law Firm Awards 2022

Discover our other annual awards Award

In a celebration of hard work, ingenuity and excellence, India Business Law Journal reveals the winners of the 2022 Indian Law Firm Awards. Vandana Chatlani reports

In the past 12...

Kumar joins Flipkart as legal M&A head

Manisha Kumar has joined Flipkart as vice president and legal head of merger and acquisitions. She joins from Cyril Amarchand Mangaldas, where she was a partner, and has more than 20 years of experience.

“It...

Raina new partner in Panag & Babu promotions

Shruti Raina has become a partner and seven other lawyers associates as The Law Offices of Panag & Babu makes its annual promotions.

Raina, who is based at the New Delhi office’s litigation and dispute...

Building trust

No legacy as rich as honesty

The world’s richest man Elon Musk’s move to take over Twitter has the world engrossed. Twitter’s hope of finding a white knight, a counter-offer to fend off Musk’s hostile...

MICECA – Key to expanding India-Malaysia economic and trade ties

On 2 April 2022, Australia and India signed their highly anticipated Economic Co-operation and Trade Agreement (ECTA), six months after negotiations between the two nations restarted in September 2021. The ECTA is seen as...

Khaitan, SAM oversee Inox PVR deal

The Indian cinema industry is set for a mega transformation as two big multiplex owners with 1,500 screens decide to merge their businesses.

Inox Leisure will buy out PVR, the country’s market leader in terms...

Telangana state picks IAMC as arbitration centre

The law department of the Telangana state government issued an order designating the International Arbitration and Mediation Centre (IAMC) in Hyderabad as the arbitral/mediation institution for all contracts above INR30 million (USD393,000) where the...

Improper communication in M&A leads to trouble

The restrictions on sharing unpublished price sensitive information (UPSI) are strict and not typical of the way such information is dealt with globally. However, by now, most stakeholders are comfortable with the standard requirements...

Insolvent financial service providers a class apart

When the Insolvency and Bankruptcy Code (IBC) was introduced in 2016, an exception was made under section 3(17) for financial service providers (FSP) to prevent them from being dragged into insolvency. The legislature has...

Discoms cannot pull the plug on contracts

The appellate bench of the Andhra Pradesh High Court has stepped in to stop the practice of renegotiation of tariffs by power distribution companies (discoms). In the case of Walwhan Renewable Energy Limited v...

RBI recasts framework for microfinance providers

Microfinance regulation has previously focused on non-banking financial companies – microfinance institutions (NBFC – MFI), and not on other entities engaged in microfinance such as banks and other NBFCs. The Reserve Bank of India...

Samvad promotes two to partnership

Samvad Partners has promoted counsel Neha Mirajgaoker and Sitara Pillai to partnership in their Mumbai office.

Mirajgaoker focuses on general corporate advisory and PE, VC investments, and M&As. She specialises in structuring transactions focusing on...

Assured increase of FDI in the insurance sector

On 14 March 2022, the government issued Press Note 1 of 2022 allowing 20% foreign direct investment (FDI) through the automatic route in the Life Insurance Corporation of India (LIC) a corporation established and...

Don’t ignore CCI’s teeth

A more considered approach to investigations during tough pandemic times should not be construed as less commitment from the Competition Commission of India’s plans to ensure fair competition, write its Former Chair Dhanendra Kumar...

Monkey business

The NSE scandal comprising a mysterious Himalayan yogi, a 'group operating officer' who had never worked in the securities market, and a board that looked the other way shows that it takes only a...

RBI relief for fintech’s credit report quandary

Reserve Bank of India's move to allow fintech companies to access credit information via credit bureaus is a positive move, but ownership and control issues remain unresolved, writes Kaushal Mathpal

A

s per the Reserve Bank...

International A-List 2022

With a remarkable spike in deal activity in 2021, who are the top 100 foreign lawyers advising clients for India-related matters?

View the A-List

Deal activity in India has once again reached a new record in...

Trilegal, FICCI team up to author ESG report

Trilegal and the Federation of Indian Chambers of Commerce and Industry (FICCI) have tabled “ESG – Into the Mainstream” – a report detailing key issues that Indian industry faces if it is to meet...

A human tragedy

There are no winners from war

The Ukraine-Russia conflict has compelled nations to walk a diplomatic tightrope. While many have waited and watched in order to craft a measured response, others went swiftly down the...

Cryptic question

Viable alternative or Dutch tulip?

There should be little surprise that India continues to struggle with the knotty problem that is virtual currencies, which according to a May 2020 ruling of the Supreme Court, “elude...

DAOism: a new kind of faith

The idea for a decentralised autonomous organisation, where the rules are baked into its code with no management structure or board of directors, has emerged with the rise of blockchain technology. Andrew Godwin examines...

Regulations to implement changes to Factoring Act

Factoring is considered an important source of short-term and working capital financing for micro, small and medium enterprises. It enables them to obtain upfront credit for invoices raised, without over-leveraging balance sheets. Factoring is...

SEBI mulls stricter disclosure norms for tech cos

The Securities and Exchange Board of India (SEBI) has proposed amendments to the valuation methods adopted by new-age technology companies, such as introducing key performance indicators (KPI) besides existing disclosures in an IPO prospectus.

The...

Regulations strengthen Gift City funds industry

The International Financial Services Centres Authority (IFSCA), which regulates Gift City, India’s first international financial services centre (IFSC), plans to introduce single registration for all fund management activities and provide a green channel for...

Former legal director starts ‘GC for hire’ firm

Surabhi Agarwal, the founder of litigation firm Parikh & Parikh Agarwal in Gurugram, has launched Global General Counsel to provide general counsel services to mid-sized companies.

With more than two decades of experience in the...

Between rocks & hard places

In the face of data requests from law enforcement agencies, conflicting legal requirements from home country and foreign jurisdictions are putting multinational tech companies in an unprecedented dilemma. How should they respond? Pan Cong,...

Court requires banks to join fight against scammers

More cases of online scamming, phishing and fraud have come to light in the recent past. In January 2022, the Delhi High Court granted an interim order in the case of Kajaria Ceramics Limited...

Humans still required in private equity

The evolution of the global economy has been largely driven by the disrupters that have revolutionised the way people work and live. Digitisation and artificial intelligence (AI) have been hailed as triggering the fourth...

FSSAI notification gives major boost to hemp industry

With a socio-economic history going back 50,000 years, hemp is one of the oldest cultivated plants in the world. But for most of the 20th century, commercial hemp production was heavily restricted. This is...

Dilemma of a nominee director sharing confidential information

Company law states that directors must fulfil their fiduciary duty and act in the company’s best interests. However, it may be challenging for a nominee director (nominee), who has also to consider the interests...

CCI now cracking down hard on cartels

The recent order of the Competition Commission of India (CCI) penalising a cartel has put the focus on implementing a robust competition compliance policy. The CCI held that four Japanese shipping companies, Nippon Yusen...

Collateral damage

As Russia’s invasion of Ukraine continues, India may find itself sucked into the maelstrom of an international legal community backlash against Russian businesses and transactions. And for India, there is much to lose. George...

Future Legal Leaders 2022

Future Legal Leaders 2024

Future Legal Leaders 2023

Future Legal Leaders 2021

India Business Law Journal identifies 50 promising lawyers who are poised for greater success

Access The List

In a time when demonstrating strong leadership...

Overview of CSR regime: Now spend or deposit

Since the introduction of the Companies Act, 2013 (act), and the Companies (Corporate Social Responsibility Policy) Rules, 2014, there have been significant changes in the legal framework for corporate social responsibility (CSR) . From...

Tightened norms for financial institutions

The Reserve Bank of India (RBI) has been gradually aligning the regulations applicable to banks and non-banking financial companies (NBFCs). Apart from implicitly recognising that NBFCs are fast narrowing the gap with banks in...

Power markets may finally spark into life

The Central Electricity Regulatory Commission (commission) in its continuing efforts to create a robust power market has introduced the Central Electricity Regulatory Commission (Power Market) Regulations, 2021 (PMR), replacing the 2010 regulations.

A large number...

Giving credit greater access to data

Digital lending in India has grown exponentially over the past 24 months powered by lending partnerships between fintech platforms and regulated lenders. A key driver has been non-traditional credit analytics that rely on alternative...

Dispute resolution in India for Japanese companies

The legal system in India is a combination of legislations and judicial precedents. The central government and state governments both legislate on subjects as prescribed in the constitution while judicial precedents are laid down...

Lock-in period to stabilise IPO listing prices

Last year was a record-breaker for the Indian IPO market, with more than 60 companies raising almost USD16 billion, the highest amount ever raised in a single year. But high IPO valuations took a...

Deconstructing AI

Hype and hysteria over artificial intelligence must be tempered to prevent knee-jerk reactions from regulators and to ensure India can reap the benefits cutting edge technology offers, write Abhivardhan and Mridutpal Bhattacharyya

To its boosters,...

Job quotas not yet working in Haryana

The state government of Haryana enacted the Haryana State Employment of Local Candidates Act, 2020 (act) and the Haryana State Employment of Local Candidates Rules, 2021, which took effect in January 2022. The act...

Overstepping the mark

The requirement to submit a test licence in the drugs and cosmetics rules goes beyond the ambit of the Parent Act, and is a hindrance to R&D for pharma companies, writes Syngene International's Shreekanth...

News in brief February 2022

DMD gets corporate

Tejveer Singh has joined DMD Advocates as a partner in its Mumbai office. Singh, who has more than 18 years’ experience, is a lawyer with dual qualifications as a chartered accountant. He...

Growing a conscience

Current events dictate that ESG considerations are increasing in importance for companies as well as regulators, warns Ashutosh Senger, lead counsel at Florence Capital

The challenges faced by societies due to the pandemic and the...

A learning curve for edtech self-regulation

With more than a quarter of its population in the 0-14 age bracket, one of the largest higher education networks in the world and internet penetration growing strongly, it is no surprise that India’s...

Nokia-Lenovo dispute: All’s well that ends well

The IP dispute provides a lesson on where parties can prioritise mutual benefits to resolve their differences, write Pravin Anand and Vaishali Mittal

E

arly 2021 saw Nokia and Lenovo, once embroiled in a series of...

Regulatory landscape for debt capital markets

Rather than being overly prescriptive, applying an even-handed approach to regulations will better serve the SEBI’s overall goals, write Aditya Bhargava and Sristi Yadav

Traditionally, debt raising in India has been skewed to borrowings from banks. From a...

Role of SEBI in ‘year of IPOs’

The capital markets regulator has facilitated IPOs in 2021, but has also sought to deter large shareholders from using them as an avenue for quick company exits, writes Manshoor Nazki

The year 2021 has undoubtedly been...

Deals of the Year

Deals of the year 2022

Deals of the year 2020

Deals of the year 2019

Deals of the year 2018

Deals of the year 2017

Deals of the year 2016

Deals of the year 2015

Deals of...

Running with the bulls

With funds raised from ipos in india at an all-time high, it is the enthusiasm of retail investors that is fuelling the charge. Georgy Thomas reports

It was a record year – a stampeding bull market...

Private equity and its impact on competition

The Competition Commission of India (CCI) is presently studying private equity (PE) investment in India in order to understand the impact that common ownership may have on competition in the relevant market. The decision...

Decoding the amended preferential allotment norms

On 14 January 2022, the Securities and Exchange Board of India (SEBI) introduced the Securities and Exchange Board of India (Issue of Capital and Disclosure Requirements) (Amendment) Regulations, 2022 (amended preferential allotment norms). These...

FDI a booster shot for the economy

In 2020, foreign direct investment (FDI) and other policies changed and ushered in a new era for the treatment of non-resident Indian (NRI) investments and income. The Ministry of Commerce and Industry in Press...

Investment opportunities in ASEAN post-RCEP

The Regional Comprehensive Economic Partnership (RCEP), the world’s largest free-trade agreement, took effect on 1 January 2022. The RCEP brings together 10 ASEAN countries, Brunei Darussalam, Cambodia, Indonesia, the Lao People’s Democratic Republic, Malaysia,...

States can regulate direct selling companies

The government of India has notified the Consumer Protection (Direct Selling) Rules, 2021, to regulate direct selling companies and network marketing operations in the country.

With the new rules, the government seeks to regulate the...

SEBI introduces special situation funds

The Securities and Exchanges Board of India (SEBI) has introduced a new sub-category under alternate investment funds to recognise special situation funds (SSFs).

On 24 January 2022, the securities regulator notified the amended SEBI (Alternative...

Way paved for gold exchanges

The government of India has declared “electronic gold receipts” (EGR) as securities and notified the SEBI (Vault Managers) Regulations, 2021, paving the way for the creation of gold exchanges in India as well as...

India and Singapore relax over stressed assets

The Insolvency and Bankruptcy Code, 2016 (code) provides for the comprehensive rules-based resolution of insolvent corporate debtors, and has become a significant and successful means of stressed asset resolution. The success of the code...