According to the data of the Asset Management Association of China (AMAC), 66,418 private equity (PE) funds have been filed with the AMAC as of the end of 2017, growing by 42.82% on a year-over-year basis. Increasingly perceived as providing greater value than merely being an asset management vehicle, PE funds are being used more and more as viable investment tools by other financial products. This article will focus on discussing how PE funds are used as investment tools by quasi-real estate investment trusts (quasi-REITs).

THOMAS WANG

邦信阳中建中汇律师事务所合伙人

Partner

Boss & Young

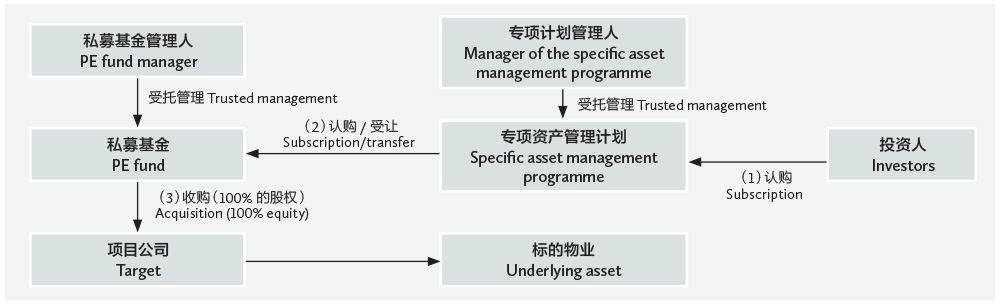

Quasi-REITs structured with reference to fundamental elements of REITs have become an important force of the asset securitization sector in China. For the purpose of this article, a quasi-REIT is an asset-backed security (ABS) programme filed with the AMAC and listed on an exchange, which is collateralized by a pool of existing properties benefiting from steady cash flow. Usually a quasi-REIT is structured in such a manner that stakes in the invested companies are held through a PE fund (please see the chart in this column for a detailed structure).

Considerations for embedding a quasi-REIT into a PE fund. There is an argument that quasi-REITs are embedded into PE funds particularly to facilitate collateral registration, public offerings, control of underlying assets, and transfer and liquidation of shares. However, the author has reservations about this opinion, given the fact that the PE funds into which quasi-REITs are embedded are often contractual funds. Instead, the author is more of the opinion that the design takes risk segregation, tax implications and restructuring of underlying assets into consideration.

Impact of the PE fund manager specialization requirement on the “equity + debt” model of quasi-REITs. Before the AMAC calls for PE fund managers to be committed to a pure-play style instead of managing two or more types of PE funds concurrently, PE fund managers were used to applying an “equity + debt” model for quasi-REITs under their management in view of tax implications. Now that the era of mixed operations has come to an end, only PE fund managers of the “other categories” will be qualified for managing private debt funds.

LI ZHIQI

邦信阳中建中汇律师事务所律师

Associate

Boss & Young

Generally speaking, a PE fund should invest not less than 80% assets into equities, whereas a private debt fund should invest not less than 80% assets into debts. Breach of these threshold requirements may expose a fund to the risk of failing AMAC filing procedure.

Does a PE fund-embedding arrangement violate the prohibition under the new entrusted loan regulations? According to Article 10 of the Measures for the Administration of Entrusted Loans of Commercial Banks taking effect on 5 January 2018, also called the “new entrusted loan regulations”, commercial banks must not arrange lending of capital under management of trustees. That is bad news for quasi-REITs, which usually provide financing for debt investments through entrusted loans in order to avoid potential invalidity risk of private lending and benefit from collateral registration allowed for trusted loans.

Since contractual funds are not bodies corporate or unincorporated associations, they have no way of arranging entrusted lending other than doing so in the name of their managers. Obviously, the capital lent out by managers through entrusted lending was trusted from investors. Therefore, the aforesaid prohibition under Article 10 should apply to trusted loans of contractual funds.

The prohibition also applies to limited partnership funds with specific asset management programmes as limited partners. Since specific asset management programmes are neither bodies corporate nor unincorporated associations, they can only arrange for managers to hold shares in the funds on their behalf. Therefore, even if limited partnership funds are allowed to be involved in entrusted lending in their own name, essentially the capital lent out is owned by investors in the programmes rather than by the programmes (i.e., limited partners of the funds) themselves.

Designed to prevent shadow financing from exposing the financial market to systematic risks, the new entrusted loan regulations make it a point to restrict asset management programmes from engaging in shadow banking activities by taking advantage of entrusted lending to circumvent regulatory requirements. However, the restrictions should not target at quasi-REITs. As standard financial products that need to be encouraged, quasi-REITs should benefit from more tolerant policies that allow greater room for innovation.

The “Quasi-REITs Forum” of the AMAC in January 2018 has made it clear that PE funds are viable investment tools for participating in quasi-REITs and they are allowed to invest in targets using a diverse range of arrangements, including equity investments, mezzanine debts, convertible bonds, and shareholder loans that meet thin capitalization rules. Apparently, AMAC agrees that PE funds are viable investment tools for investing in quasi-REITs, although there is still a long way to go before regulators reach a consensus. Given the current regulatory environment, structures of quasi-REITs will need further exploration and innovation.

Thomas Wang is a partner and Li Zhiqi is an associate at Boss & Young

中国上海市黄浦区中山南路100号

金外滩国际广场12-15楼 邮编:200010

12/F-15/F, 100 Bund Square

100 South Zhongshan Road

Huangpu District, Shanghai 200010, China

电话 Tel: +86 21 2316 9090

传真 Fax: +86 21 2316 9000

电子邮箱 E-mail:

thomas_wang@boss-young.com

lizhiqi@boss-young.com