The China (Shanghai) Pilot Free Trade Zone has introduced a raft of new policies to facilitate foreign investment. The table below attempts to summarise significant reforms that the zone has to offer, and we will analyse some of these in further detail in this article, along with more complex issues that require further clarification.

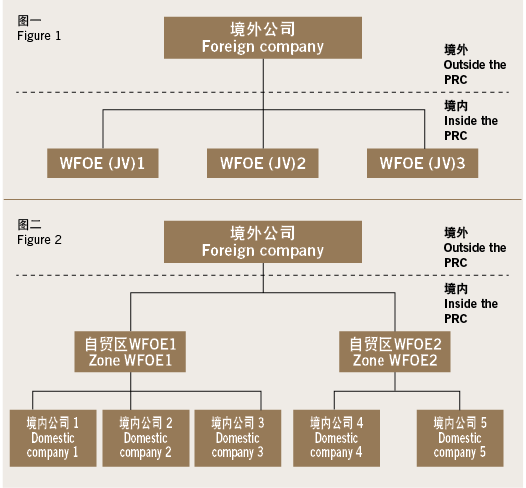

Pursuant to relevant regulations, the zone will implement free convertibility by FIEs on the capital account and explore innovative exchange control models. Given this, when FIEs registered in the zone reinvest, they may soon be able to surmount the restrictions imposed by document No. 142 by establishing multiple wholly foreign-owned enterprises (WFOEs) in the zone to serve as the platforms for investments in different projects in China, giving them more flexibility in their investments (see Figure 2).

You must be a

subscribersubscribersubscribersubscriber

to read this content, please

subscribesubscribesubscribesubscribe

today.

For group subscribers, please click here to access.

Interested in group subscription? Please contact us.

你需要登录去解锁本文内容。欢迎注册账号。如果想阅读月刊所有文章,欢迎成为我们的订阅会员成为我们的订阅会员。

Jeremy Dai is a partner at AnJie Law Firm. He can be contacted on +86 10 8567 5971 or by email at: jeremydai@anjielaw.com. Wilson Lu is a lawyer with the firm. He can be contacted on +86 10 8567 5991 or by email at: luqunwei@anjielaw.com. Wang Xin is also a lawyer with the firm. He can be contacted on +86 10 8567 5993 or by email at: wangxin@anjielaw.com