Investment in red chip structures by domestic Renminbi funds is, on the one hand, affected by state policies on overseas direct investment (ODI) and, on the other hand, affected by the industry regulations promulgated by the Asset Management Association of China (AMAC) because the investing entity is a fund. After senior officials of the National Development and Reform Commission, the Ministry of Commerce, the People’s Bank of China and the State Administration of Foreign Exchange responded, in December 2016, to media’s questions on strengthening the regulation of outbound investment under the current circumstances, a series of documents, including the Guiding Opinions on Further Guiding and Regulating the Direction of Overseas Investment (Document No. 74), the Administrative Measures for the Outbound Investment of Enterprises (Order No. 11), etc., were issued in succession. In practice, regulatory authorities in various regions pay close attention to such outbound investments as large investments in business that are not the main business of the investor or outbound investments made by limited partnerships, etc., and handle them on a case by case basis. Therefore, in practice, many Renminbi funds choose to build certain structures to accomplish their investments in red chip structures before they complete the ODI procedures.

Partner

Guantao Law Firm

On the other hand, commencing with the issuance on 31 March 2017 by AMAC of the Answers to Questions Relating to the Registration and Recordal of Private Funds (13), which puts forward the principle of professional management of private funds, each subsequent document, including the Guiding Opinions on Regulating the Asset Management Business of Financial Institutions (New Asset Management Rules), has continuously reinforced this principle. On 30 September 2018, AMAC issued the Notice on Matters Relating to Strengthening the Administration of the Self-Regulation of Information Disclosure by Private Funds, making the requirements of information disclosure by private funds more stringent, and making the investment, management and exit of funds more transparent. Accordingly, when designing the investments in red chip structures by domestic private Renminbi funds, we need to fully consider the above mentioned regulations from the regulatory prospective of the fund industry.

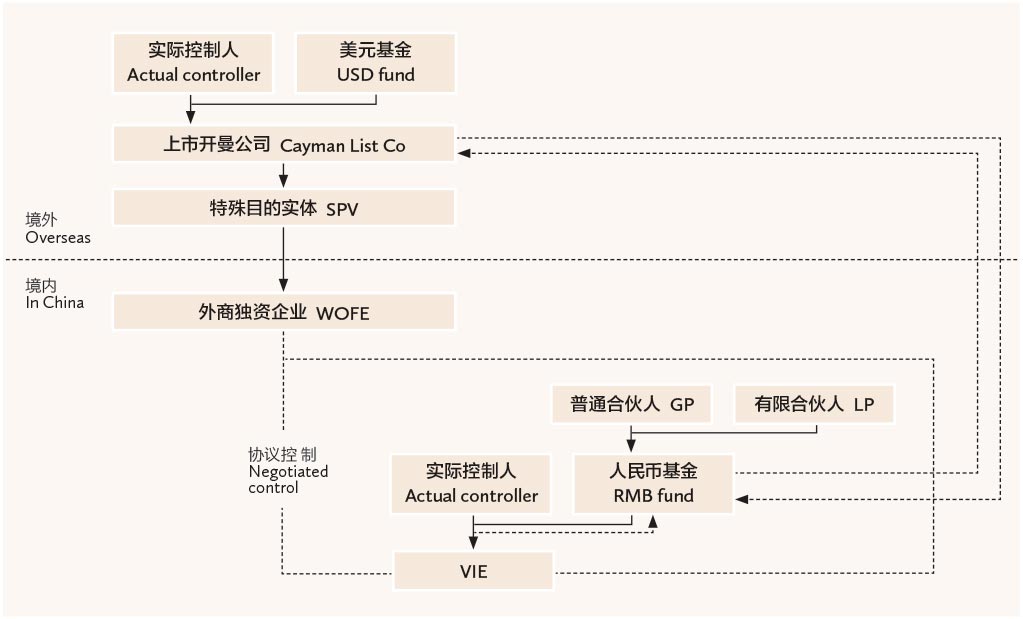

Below we analyze the basic structure of, and the points to be focused in, the investments in red chip structures by domestic Renminbi funds:

- The investment in a target company by a Renminbi fund will usually take the form either of a loan or an equity investment. It is usually considered that the loan model is more flexible, but the default cost of the target company under the loan model is relatively low. Furthermore, pursuant to current regulatory requirements of AMAC, a private equity Renminbi fund is required to satisfy the requirement that the amount of its loan may not exceed 20 percent of the size of it. If a fund is not large enough, or if the fund only invest in a single target, then the loan method is not feasible from AMAC’s regulatory prospective.

- Common methods for a Renminbi fund to secure equity from an entity that intends to list on a foreign stock market may include options, warrants or parallel funds. Regardless of the method, particular attention needs to be paid to not impairing the tax base. Furthermore, if the holding of the shares of the company proposing to list abroad is ultimately done by another holding party rather than through ODI, then special attention needs to be paid to the following aspects: (i) the specific arrangement shall comply with the requirements of the foreign listing regulator; and (ii) the income tax rate applicable to the foreign holding entity, so as to reduce the transaction costs.

- When a Renminbi fund decides to exit, if an offshore shareholding structure is ultimately accomplished after the completion of ODI procedures, all of the proceeds derived from selling the shares of the foreign listed company may be remitted back to China. If adopting a parallel shareholding structure, then the Renminbi principal and reasonable profits arising therefrom shall be withdrawn in China in order to avoid the Renminbi fund being challenged by AMAC from the prospective of fund regulatory.

How to handle the inability of a Renminbi fund to directly remit part of its overseas proceeds back to China due to its failure to complete ODI procedures currently remains in a gray area. In some cases, an affiliate of Renminbi fund’s investors will execute a series of agreements with the foreign holding entity hoping to use a relatively legitimate method to transfer those income to the affiliate of the Renminbi fund’s investors, however, the compliance of the domestic Renminbi fund at the AMAC regulation level should not be affected.