Against a background where exchange policy relating to cross-border investment has tightened, a Shenzhen investment company (company A) proposed to invest US$6 million in a US company (company B), and executed an investment agreement in December 2016. Company A was established in December 2015 with registered capital of RMB5 million (US$727,000).

Partner

Zhong Lun Law Firm

When Company A applied to the Economy, Trade and Information Commission (ETIC) of Shenzhen municipality for recordal of an offshore investment project, the ETIC refused to accept on the grounds that the company’s name and scope of business contained the word “investment”. Following inquiries, the authors were able to confirm that even if the application was changed to a suitable investment entity (one that was established for a relatively long period of time, had registered capital greater than US$6 million, and did not have the word “investment” in its name and scope of business), the amount of time required for approval by the ETIC was uncertain.

Against this background, domestic enterprises are encountering some obstacles in the course of cross-border investment, and where funds cannot be sent abroad directly, an increasing number of offshore investments have turned to “foreign loans secured by domestic security” as an indirect means of doing so. In simple language, a foreign loan secured by domestic security involves a domestic entity providing security for a foreign borrower, and when the foreign borrower is unable to repay the foreign debt, the domestic guarantor is required to perform its security obligations, remitting funds abroad to be used to repay the foreign debt to the foreign lender.

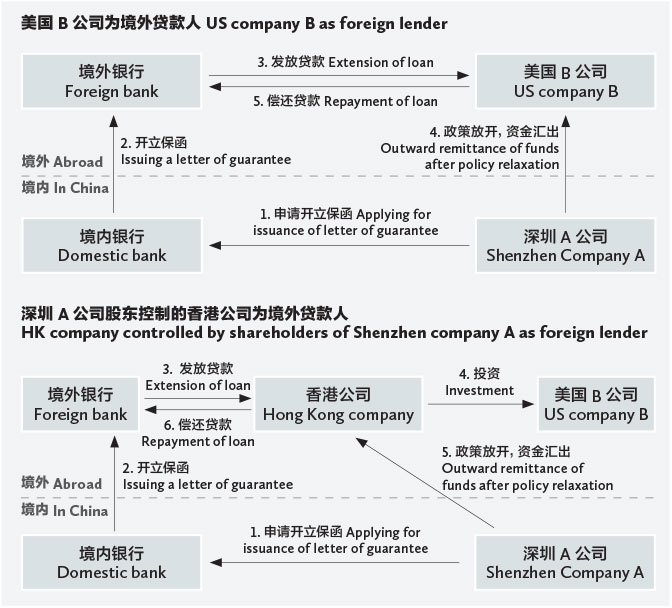

Through conversations with a certain state-owned bank, the authors learned that there were two options available to Shenzhen company A to send funds abroad to invest in US company B through a foreign loan secured by domestic security (see the figures). The first option is for company A to only reflect that it holds a claim against US company B. How the same is reflected and how the investment returns are to be obtained require stipulation in a series of complementary agreements, something that gave company A certain misgivings. The second option is more direct – establishing a Hong Kong company to directly hold equity of company B, to be followed by internal adjustment of the equity between company A and the Hong Kong company once the exchange policy relating to direct foreign investment is relaxed.

Points of focus in bank review

When handling matters relating to a foreign loan secured by domestic security, the bank will focus on the capacity to repay the foreign loan and the chance that the letter of guarantee will need to be performed. When conducting due diligence, the bank will carry out its review from multiple angles, such as the lawfulness of the qualifications of the entities, commercial reasonableness, purpose of the proceeds of the master debt, chance of performance, whether potential conflicts exist, etc.

Associate

Zhong Lun Law Firm

In the cases above, under the first scenario, the bank would focus on whether US company B has genuine operations and whether its operating revenues in two to three years can cover the loan, and would need to calculate the cash flow of company B in the coming three years. Under the second scenario, the repayment capacity of the Hong Kong shell company itself is limited, so when the bank conducts its review of whether the Hong Kong company has the capacity to repay, it would consider such factors as the Hong Kong company’s own repayment capacity, whether the target company has stable dividends that can top up the repayment source, and whether the Hong Kong company has other affiliates that could provide a repayment source.

Most recent policy

However, the Provisions for Exchange Control Relating to the Provision of Cross-border Security specify that, “when the financing proceeds under a contract for a foreign loan secured by domestic security are used to directly or indirectly acquire equity in another offshore organization (including a newly established offshore enterprise, acquisition of equity in an offshore enterprise, or participation in the capital increase of an offshore enterprise) or claims therein, such investment act shall comply with the regulations on offshore investment of relevant domestic authorities”.

The Policy Questions and Answers on the Notice of the State Administration of Foreign Exchange (SAFE) on Further Promoting Exchange Control Reform and Improving Reviews of Genuineness and Compliance (2) further clarify that, “in an offshore investment project where offshore financing obtained through a foreign loan secured by domestic security substitutes for the sending abroad of funds by the domestic organization, if the domestic organization’s offshore investment in equity is, in accordance with current regulatory principles governing investment abroad, subject to restrictions, handling of relevant offshore security matters is provisionally put on hold, and if the guarantor is not a banking institution, the SAFE will not carry out registration of a foreign loan secured by domestic security for it; if the guarantor is a bank, it may not provide the security.”

Given that the enforcement of the policy on regulation of cross-border investment in different regions, and by different banks, and the yardsticks held when conducting reviews for foreign loans secured by domestic security may not be completely consistent, investors, when formulating their plans, should seek the advice of the competent authorities and banks based on their individual cases.

Rao Xiaomin is a partner and Zhou Jun is an associate at Zhong Lun Law Firm in Shenzhen

中国广东省深圳市福田区益田路6003号

荣超商务中心A栋9-10楼 邮编:518026

9-10/F, Tower A, Rongchao Tower

6003 Yitian Road, Futian District

Shenzhen 518026, Guangdong, China

电话 Tel: +86 755 3325 6666

传真 Fax: +86 755 3320 6888/6889

电子信箱 E-mail:

raoxiaomin@zhonglun.com

zhoujun@zhonglun.com

www.zhonglun.com