Rico Chan analyses how the fast-growing ABS market may help China’s real estate sector find a blueprint for new fundraising products

The Asset-backed securitization (ABS) market in China has been growing rapidly since 2015. The direct reason was deregulation of ABS transactions starting in late 2014, when China moved from an approval system to a registration system for ABS products. The underlying policy reason for the deregulation was that the central government needed to reduce leverage in many business sectors. When the global financial crisis occurred in late 2008, China quickly responded with its massive economic stimulus programme at the national level.

For various political and economic reasons, these national and local economic stimulus programmes could not fundamentally re-invigorate China’s economy. China then faced the situation of a slowing economy, while many business sectors, such as real estate and infrastructure, struggled with over-capacity and over-leverage.

In order to avoid the over-leverage in these oversupplied sectors translating into a systemic risk in the country’s banking system, China had to find ways to quickly reduce financial leverage in these sectors. ABS was one of the central government’s chosen methods to achieve this policy objective. By allowing companies and financial institutions in these sectors to use their assets to issue ABS products more easily, the central government could achieve deleveraging in these sectors more quickly.

Apart from the above-mentioned reasons, in the real estate sector different market players have been testing ABS and other securitization structures with a view to establishing a blueprint for China’s future markets for real estate investment trusts (REITs) and commercial mortgage backed securitization (CMBS).

ABS in essence means a company or financial institution (typically called the “originator”) issuing securities to investors on the basis of the cashflow derived from a specific pool of business assets of the originator, such as loan portfolios, account receivables or certain contractual rights.

ABS securities are often, though not always, listed and traded on an exchange to give the securities liquidity. Quite often certain internal or external credit enhancement features are structured into the ABS securities to strengthen their credit standing. ABS securities are often rated by local or international rating agencies.

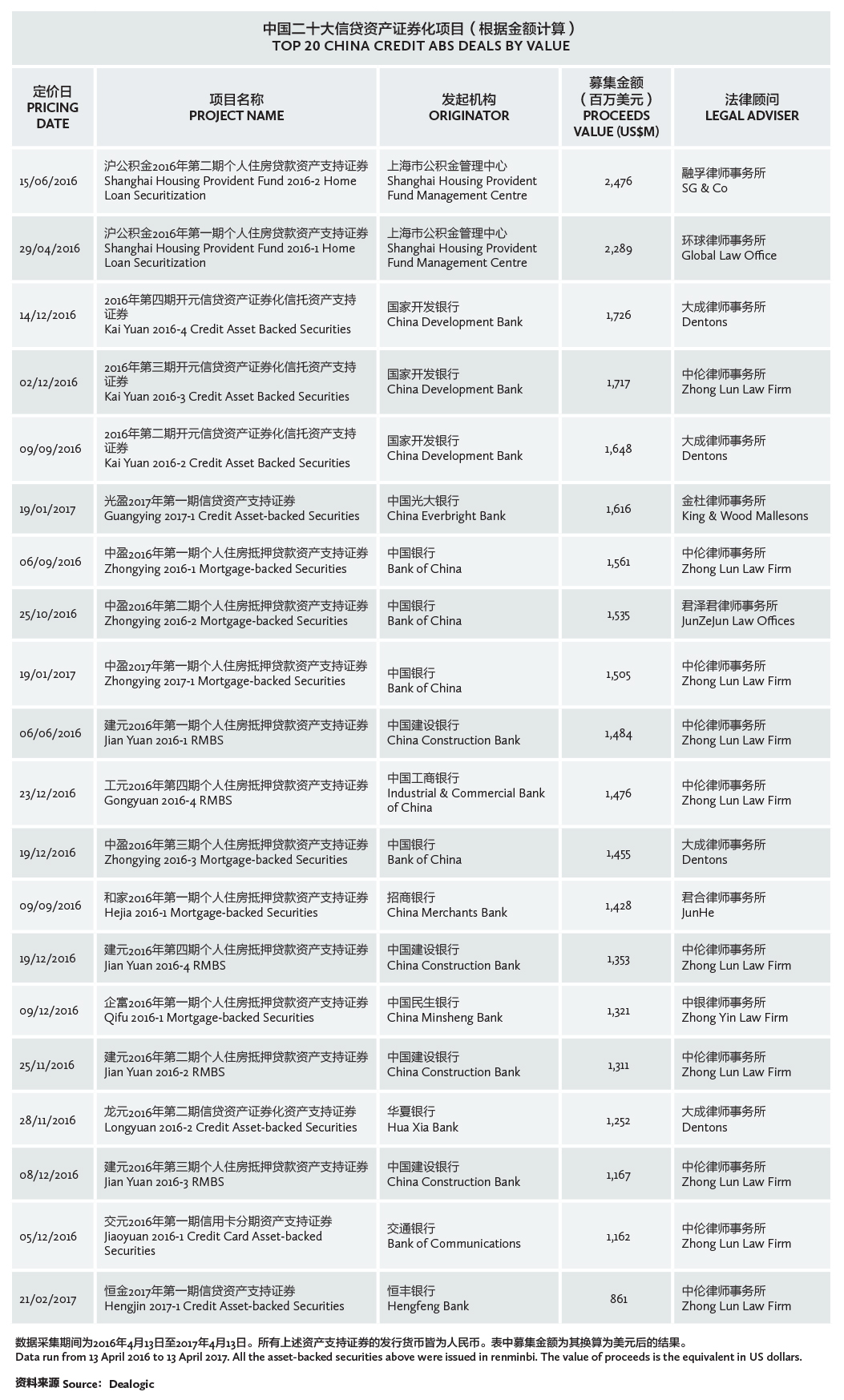

There are two types of ABS products in China. The first is “credit asset ABS products”, originated by banks and other financial institutions using their loan portfolio such as corporate loans, residential mortgage loans, auto loans, credit card loans, etc. These ABS products are regulated by the China Banking Regulatory Commission (CBRC) and are traded on the China Inter-bank Bond Market (CIBM) in Shanghai among “qualified institutional investors”.

The second is “corporate asset ABS products” originated by companies using a wide range of business assets such as real estate ownership, real estate rental income, property management fees, hotel operating income, toll road fees, account receivables, etc. These ABS products are regulated by the China Securities Regulatory Commission (CSRC) and are traded on the block trade section of the Shanghai or Shenzhen stock exchanges among qualified investors.

Actually, there are two other types of ABS products. There are “insurance assets ABS products” originated by insurance companies using their insurance assets. These ABS products are regulated by the China Insurance Regulatory Commission (CIRC) and are traded on the Shanghai Insurance Exchange. There are also “asset backed notes” (ABN) regulated by the National Association of Financial Market Institutional Investors (NAFMII) and traded on the CIBM. But the market scale for these two types of ABS products is much smaller compared with credit and corporate assets ABS products.

CMBS-TYPE ABS PRODUCTS

A recent and typical example is the “Financial Street (Phase 1) Special Asset Management Plan” originated in 2016 by the Financial Street Holdings Group (FSH), a state-owned real estate development group listed on the Shenzhen Stock Exchange. Some market commentators regard it as China’s current version of “commercial mortgage backed securitization” (CMBS).

You must be a

subscribersubscribersubscribersubscriber

to read this content, please

subscribesubscribesubscribesubscribe

today.

For group subscribers, please click here to access.

Interested in group subscription? Please contact us.

你需要登录去解锁本文内容。欢迎注册账号。如果想阅读月刊所有文章,欢迎成为我们的订阅会员成为我们的订阅会员。

Rico Chan is a partner at Baker McKenzie in Hong Kong