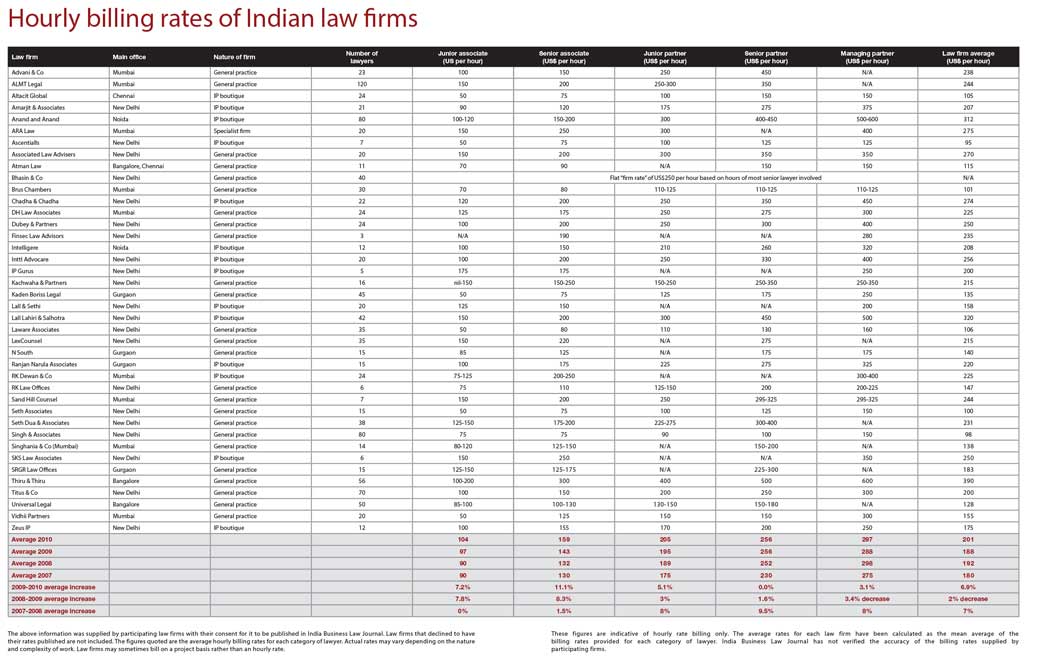

India Business Law Journal’s fourth annual billing rates survey reveals rising hourly rates and growing demand for alternative fee arrangements

Vandana Chatlani reports

Over the last few years, lawyers, some sympathetically others less so, have reduced their fees as clients coped with the pressure of cutbacks. Now, as economies rebound, companies are getting back on their feet. However, the tough negotiation over legal fees continues.

The result is bold statements like: “Pay us what you think the work was worth”, which is one of the payment options offered by CMS Cameron McKenna in a recent report it published on legal fees. India’s law firms would probably find such a proposition laughable and question if such an idea could work in a society where haggling is the norm.

Nevertheless, CMS Cameron McKenna’s report, entitled The future of fees: your route map to value, suggests reforming billing structures is a key priority and one that clients take very seriously. According to senior partner Richard Price, “It’s not always about being innovative to be cheaper; it’s often about being innovative to add value in a precise way that matters to a particular client’s organization.”

You must be a

subscribersubscribersubscribersubscriber

to read this content, please

subscribesubscribesubscribesubscribe

today.

For group subscribers, please click here to access.

Interested in group subscription? Please contact us.