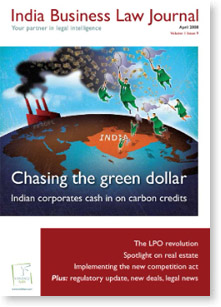

When it comes to feeling the effects of other people’s problems, India has developed a canny knack for turning misfortune elsewhere to its advantage

As ever, Shakespeare’s pithy phrasing lends perspectives on the contradictory signals emerging from the global economy – and on India’s place within it. Where some see misfortune, others see opportunity.

India Business Law Journal

Global stock exchanges fall … then rise … then fall again. But India, which has experienced more turbulence than most, has been crowned a “capital markets hotspot” by one leading international law firm (News). European businesses are grappling with increasingly onerous environmental regulations but Indian companies are raising millions of dollars through the sale of carbon credits. And while US property markets reel from the fallout of the sub-prime crisis, Indian real estate prices are soaring by as much as 50% a year.

You must be a

subscribersubscribersubscribersubscriber

to read this content, please

subscribesubscribesubscribesubscribe

today.

For group subscribers, please click here to access.

Interested in group subscription? Please contact us.