In answering questions raised by journalists in January, a spokesman for the Shanghai Stock Exchange (SSE) reckoned that the SSE would take strict precautions against five risks in mergers and acquisitions (M&A), including leverage risk, transaction risk, crossover risk, integration risk and impairment risk.

Junior Partner

Grandway Law Offices

Among these risks, the leverage risk is the first to be prevented. Listed companies must disclose in key detail information about leverage funds, including their sources, percentages and arrangements for subsequent repayment, and make notice of risk in conspicuous places. Does it necessarily mean that leveraged buyouts have become a high-risk area of M&A regulation? And to what degree do the market and regulators accept leveraged buyouts? This article explores these two questions via two successful cases in 2016.

Xiwang Food’s acquisition of KEER

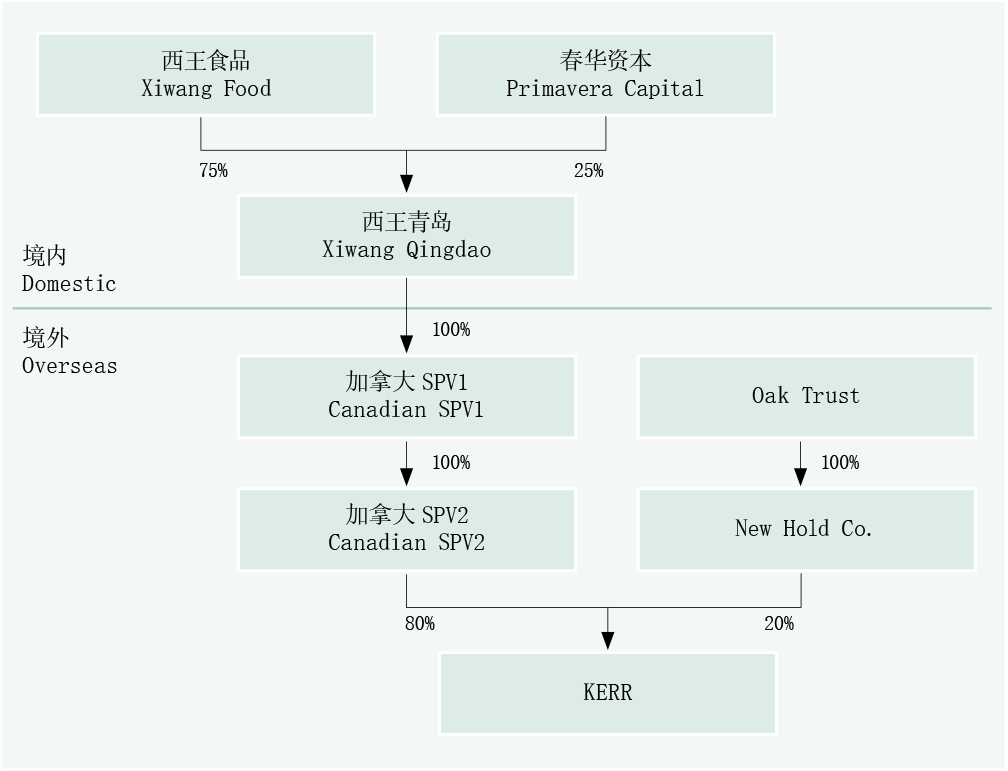

In September 2016, Xiwang Food, a Shenzhen-listed company, and Primavera Capital jointly acquired the full shares in KERR in cash at US$730 million (80% of shares were delivered in the first instalment at about US$584 million, equivalent to about RMB3.9 billion, and the consideration for the remaining 20% of shares to be paid by Xiwang Food). The transaction structure is shown in the accompanying graphic.

Xiwang Food and Primavera Capital, the financial investor, jointly established Xiwang Qingdao and, by taking Xiwang Qingdao as the subject, ultimately hold the underlying asset through two overseas special purpose vehicles (SPVs). The underlying asset (with KERR having 80% of shares) was priced at RMB3.9 billion.

Approvals and regulations involved in cross-border transactions are complicated. In order to reduce transaction difficulties, this transaction was made in cash, though it was of acquisition of significant assets. Therefore, the examination and approval by the China Securities Regulatory Commission (CSRC) was avoided. Xiwang Food did not issue any shares, but made full cash payment with funds from the following sources: (1) RMB1.69 billion and RMB564.3 million invested in Xiwang Qingdao by Xiwang Food and Primavera Capital, respectively; and (2) an acquisition loan of Xiwang Qingdao at RMB1.67 billion (an entrusted loan extended by the financial investor Primavera Capital through a bank).

In this case, Xiwang Food had a very low asset-liability ratio before acquisition. With introduction of capital from its financial investor, plus its proprietary funds and bridge loans, it acquired the underlying asset quickly. In addition, the non-public offering plan announced together with the reorganization report showed that Xiwang Food would raise RMB1.67 billion by non-public offering to pay/repay the acquisition fund. It made full use of its advantages as a financing platform of a listed company.

Reorganization of Changjiang Runfa

Changjiang Runfa, which passed examination and approval of the CSRC in July 2016, purchased 100% of shares in Changjiang Pharmaceutical by issuing shares and paying cash to its majority shareholders and four financial investors, which enabled a transformation of Changjiang Runfa from a system part manufacturer to a pharmaceutical company.

The core of the plan is as follows: After Changjiang Runfa had the explicit intention of acquisition, its majority shareholders and four financial investors jointly established Changjiang Pharmaceutical as the acquisition platform. Upon successful acquisition of three pharmaceutical enterprises by Changjiang Pharmaceutical, Changjiang Runfa then purchased 100% of shares in Changjiang Pharmaceutical via the share issuance and cash payment. The majority shareholders not only received a large amount of consideration for shares but also stabilized their control.

There is no doubt that it greatly improved the efficiency of bridge acquisition of an acquisition platform that took a listed company as the final exit channel. At this stage, Changjiang Runfa did not use their proprietary funds, but provided increased creditability for the financing of majority shareholders with its own credit. In 2015, and from January to June 2016, the earnings per share of Chang-jiang Runfa were RMB0.22 and RMB0.07, respectively, with a distinct decline. Therefore, the listed company sought to transform itself and develop in the pharmaceutical industry.

It should also be noted in this plan that the partial cost for the bridge loan was included in the consideration for the reorganization transaction and paid by Changjiang Runfa. The underlying asset was sold to Changjiang Runfa at RMB3.5 billion. There is a difference between the price and the consideration of RMB2.9 billion for the bridge acquisition by the majority shareholders, mainly because of the inclusion of the cost for a bridge loan at RMB400 million, which is the cost of the majority shareholders and four financial investors for paying an annualized interest rate of the bridge acquisition ranging from 9% to 15%. This estimation and amortization were finally recognized by the regulator.

It can be seen from these two cases of using leveraged buy-outs that the core of regulation still lies at whether the underlying asset itself may bring revenue to the listed company, and whether the reorganization is deductive to the industrial upgrade and transformation of the listed company. The purpose of seeking industrial distribution by acquiring assets in North America, or transforming a conventional manufacturing enterprise into a pharmaceutical or medical one, is to transform, upgrade and foster new points of growth, and ultimately serve the real economy.

Cui Bai is a junior partner at Grandway Law Offices

北京市东城区建国门内大街26号

新闻大厦7层 邮编:100005

7/F, Beijing News Plaza

No. 26 Jianguomennei Dajie

Beijing 100005, China

电话 Tel: +86 10 8800 4488 / 6609 0088

传真 Fax: +86 10 6609 0016

电子信箱 E-mail:

cuibai@grandwaylaw.com

www.grandwaylaw.com