In the articles of the two preceding issues, the author focused on describing the trend in the restructuring of offshore assets and the future plan of the China (Shanghai) Pilot Free Trade Zone (FTZ), while also sketching out four schemes for the restructuring and acquisition of offshore assets by listed companies. In this issue, the author will lay out a further two schemes, one of them particularly aimed at enterprises in the FTZ carrying out offshore acquisitions.

Sun Jian

中银律师事务所

高级合伙人

Senior Partner

Zhong Yin Law Firm

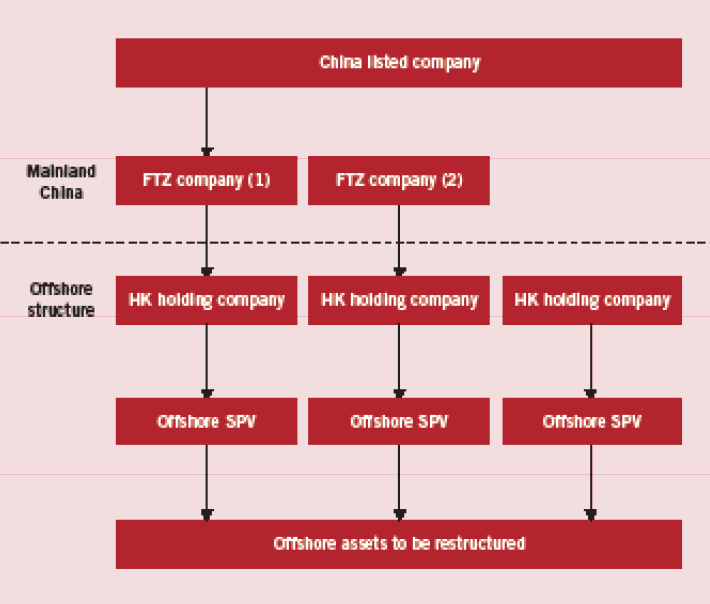

Scheme 5: The equity in the subject assets to be restructured is first dispersed and then injected into the listed company.

The listed company can first disperse the equity in the assets to be restructured and then inject it, step by step, into the listed company. The operational procedure is shown in the graphic on this page.

Avoiding risk

The advantage of this scheme is that it avoids triggering the risks of a backdoor listing. The listed company first controls a relative majority of the equity in the FTZ company, becoming the actual controller of the offshore assets to be restructured. Subsequently, in accordance with the requirements of the Enterprise Accounting Standards, No. 33: Consolidated Financial Statements, the offshore assets to be restructured are included on the consolidated statements, and their gradual injection is gradually realised.

Scheme 6: New scheme involving an offshore acquisition by a fund and large private enterprise established in the FTZ.

In normal circumstances, the completion of an offshore equity investment by a Chinese enterprise has to pass through the hands of at least three government regulators, each of them meticulously holding the line. The pile of application material is thick, but each application document needs to be strictly reviewed, with problems possibly lurking at any stage. In this way, completion of an offshore investment requires three to six months of dragged out approvals.

Special explanation

Furthermore, when a Chinese enterprise carries out an offshore acquisition, it usually needs to give a special explanation to the target assets, and secure the consent and approval of the government, which requires a further few months. The long time, to a great extent, will ultimately lead to the seller of the international assets, and its financial advisers, refusing the quote due to the intrinsic uncertainty that this length of time gives rise to.

Success rate increases

Under the implementation of new policies in the FTZ, the efficiency and success rate of offshore acquisitions by Chinese enterprises has greatly increased. As at the end of April 2014, the FTZ had handled 30 offshore investments involving 11 jurisdictions totalling US$873 million.This is not unrelated to such policies as the openness principle, after the fact monitoring, etc., implemented in the FTZ, and the objective and reasonable acquisition schemes adopted by enterprises in the FTZ.

In February 2014, Hony Capital took advantage of the cross-border investment platform that is the FTZ to invest US$30 million abroad and acquire PPTV in conjunction with Suning Appliance. Hony Capital’s scheme is as follows: first establish a fund management company and a fund company in the FTZ; then secure the relevant recordal for a cross-border investment project in accordance with FTZ rules and apply to the foreign exchange bureau for currency conversion to complete the cross-border investment.

Same starting line

The foregoing procedures required a total of five working days. In this manner, Chinese companies can stand at the same starting line as the best companies internationally when it comes to offshore acquisitions.

Both of the two above-mentioned schemes have their advantages and disadvantages, so the author would ask readers to objectively and reasonably make their choices, based on the enterprises’ actual circumstances.

Jonathan Sun is a senior partner at Zhong Yin Law Firm

中国北京市朝阳区东三环中路39号

建外SOHO-A座31层

邮编: 100022

31 Floor, Jianwai SOHO A

Dongsanhuan Zhonglu 39, Chaoyang District

Beijing 100022, China

电话 Tel: 86 10 5869 8899

传真 Fax: 86 10 5869 9666

电子信箱 E-mail:

sunjian@zhongyinlawyer.com

www.zhongyinlawyer.com