The Supreme People’s Court (SPC) recently issued the Summary of the National Courts’ Civil and Commercial Trial Work Conference (Opinion Draft), which is the first time that the court has responded positively to the VAM clause and guided its design in PE/VC practice.

PacGate Law Group

Partner

WHAT IS THE VAM?

VAM refers to the Valuation Adjustment Mechanism, or the arrangement of uncertainties in equity financing agreements.The fundraiser guarantees to achieve the set goals within a certain period of time,and otherwise it shall compensate the investor by means of equity repurchase or payment of cash.

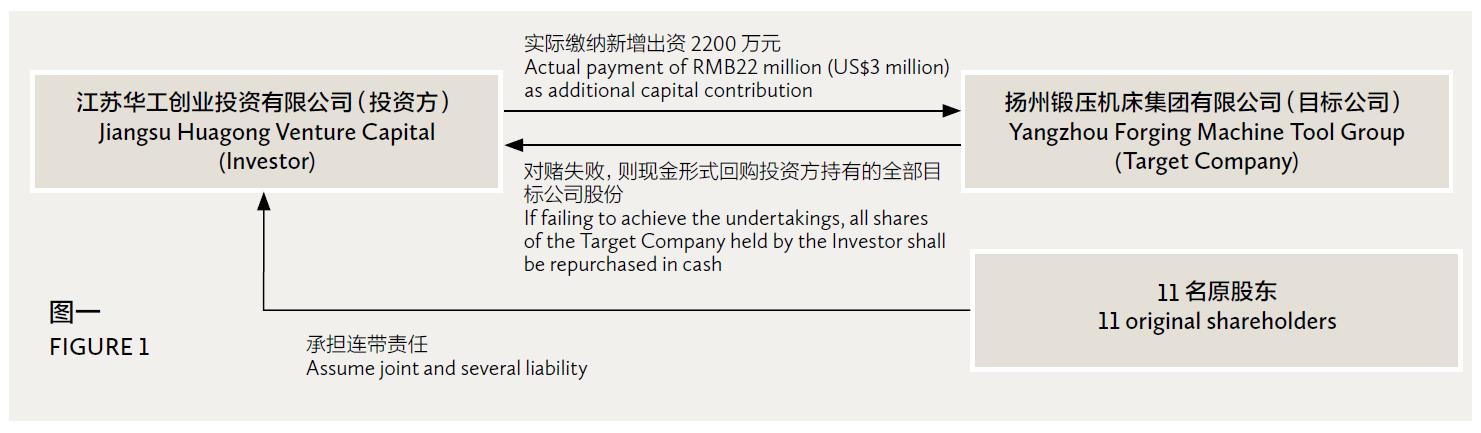

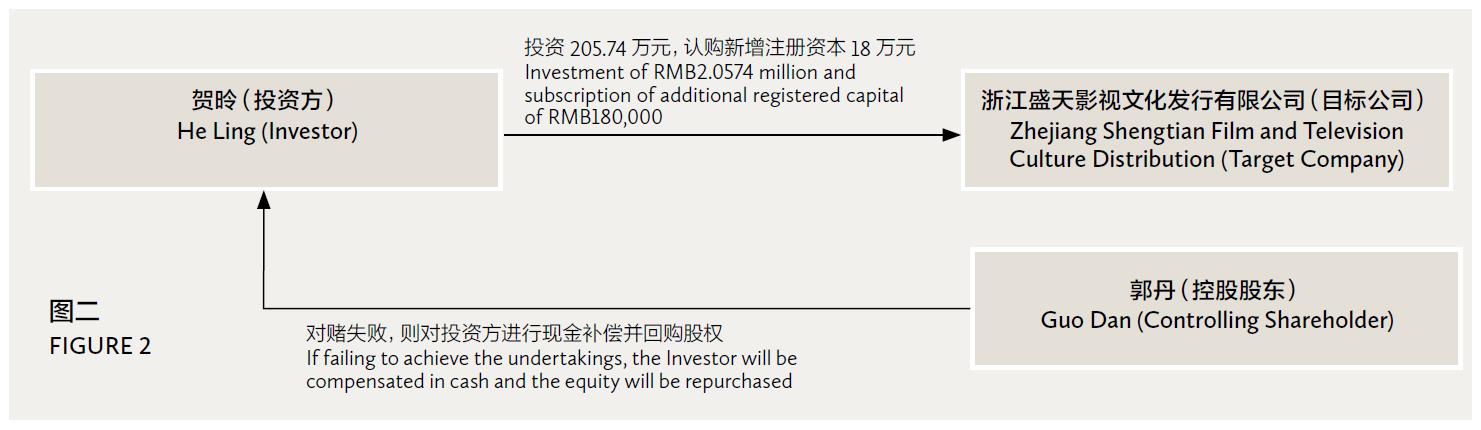

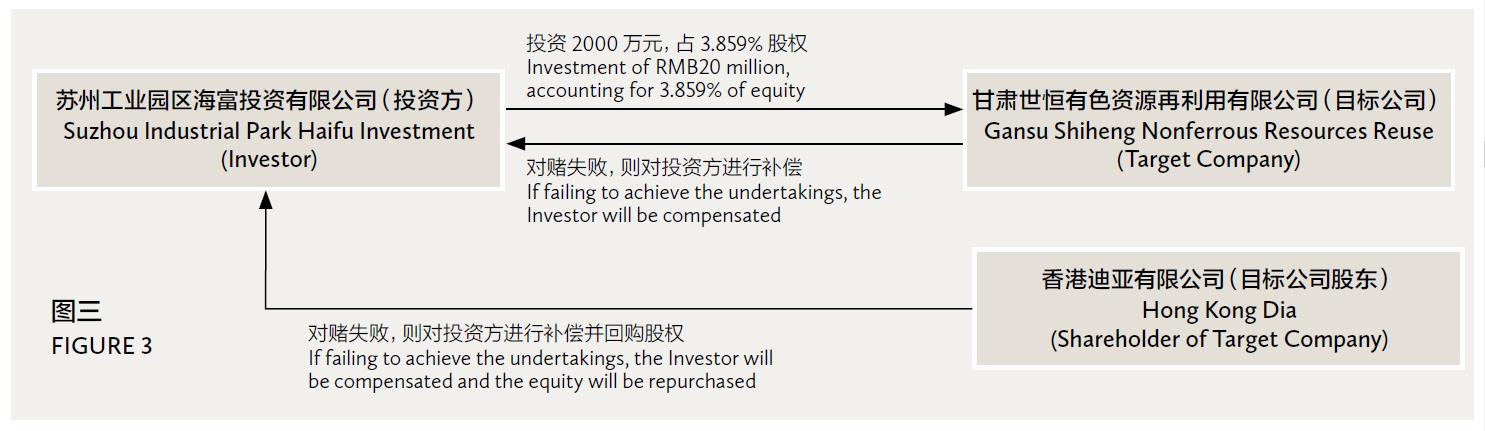

Who conducts a VAM? In practice,there are three forms of VAM, that is,between an investor and a company, between an investor and a company’s shareholders, or between an investor on one side, and a company and its shareholders on the other. These typical cases are detailed in Figures 1, 2, and 3, respectively.

What are the conditions of a VAM? Performance and listing time are common conditions of a VAM in practice, such as “the net profit after tax achieved in XX year shall not be less than RMBXX” or “the listing shall be completed before a specified date”.

PacGate Law Group Associate

Ways to assume liability for a VAM. (1) Cash compensation: the common formula is “compensation amount = investment amount *(1- actual annual net profit / committed annual net profit)”; (2) Valuation adjustment: transfer the equity to the investor at a low price or free of charge, or allow the investor to purchase additional equity at a low price; and (3) equity repurchase: the company or its shareholders shall repurchase the equity held by the investor based on the investor’s investment fund plus the agreed return.

HOW VALID IS IT?

The Haifu case (Figure 3). The SPC held in the “First Case of VAM”, the Haifu case, that a VAM between an investor and the shareholders of a company is valid, but a VAM between an investor and a company is void because it enables the investor to obtain relatively fixed returns without regard to the company’s operating performance, and thus directly or indirectly impairs the interests of the company and its creditors. The court judgments after the Haifu case and before the Huagong case basically followed this view.

A reversal by the Huagong case (Figure 1). Two months before the release of the opinion draft, Jiangsu High People’s Court decided in the retrial judgment of the Huagong case that the equity repurchase clause between an investor and a company was valid, which led many to regard the Huagong case as a reversal of the Haifu case.

The reasoning of Jiangsu High People’s Court is as follows: (1) a company’s repurchase of the company’s equity does not necessarily violate the mandatory provisions of the Company Law; (2) a company’s repurchase of the company’s equity will not harm the interests of shareholders or creditors of the company, and will not violate the capital maintenance doctrine of companies; (3) a VAM is the parties’ true expression of intent with respect to investment commercial risk; and (4) the parties’ agreement on the repurchase price conforms to the normal business rules.

An analysis of the opinion draft. The opinion draft makes it clear that if the VAM between an investor and a company does not have any cause affecting the validity of the contract, it shall be recognized as valid. Whether a decision can be made to enforce the VAM depends on whether it meets the mandatory provisions of the Company Law on equity repurchase or profit distribution.

(1) The validity of a VAM clause. The key is to decide whether there are any factors in a VAM clause that may affect the validity of the contract according to article 52 of the Contract Law. If there is no violation of the mandatory provisions of the law and administrative regulations in a VAM, it shall be deemed valid;

2) Whether a VAM clause can be fulfilled. Whether there are legal and factual possibilities to fulfil a VAM clause. In other words, whether the repurchase of equity meets the requirements of the Company Law for the acquisition of the company’s shares, or whether there is a distributable profit to compensate investors in cash.

HOW VALID IS IT? KEY POINTS OF VAM DESIGN

The VAM clause should be valid. In summary, the validity of the VAM clause is not necessarily related to the party with whom an investor enters into the VAM clause. However, considering that the court will need to conduct a case-bycase analysis when a company assumes the liability under the VAM clause, the parties with whom an investor may enter into the VAM clause are listed as follows in a descending order: (1) a company and its shareholders; (2) the company’s shareholders (the company may be added for assuming joint and several liability); (3) the company (with its shareholders assuming joint and several liability; the limitation of joint and several liabilities may be added according to circumstances, such as limited to the value of equity); and (4) the company.

It should be possible to fulfil the VAM clause. The validity of the VAM clause does not mean that the investor’s claim will be supported by the court, and the following premises should also be guaranteed:

(1) Legal premise. The VAM clause must comply with the mandatory provisions of the Company Law on share repurchase or profit distribution. In case of share repurchase, the repurchase can only be to reduce the company’s capital. If it is cash compensation, the company must be profitable and meet the requirements of withdrawing reserves.

(2) Factual premise. Whether the VAM clause can be implemented actually depends on whether its performance will affect a company’s ability to pay off debts, or whether it will materially damage the company’s assets. For example, creditors can ask the company to pay off its debts or provide security during the notice period of capital reduction.

Dispute resolution. Compared with the court, arbitration institutions are more inclined to confirm the validity of the VAM clause between an investor and a company. Therefore, an investor may prefer arbitration when choosing the dispute resolution method of the transaction documents.

SOME ANALYSIS

The Huagong case and the Opinion Draft clarify the inherent logic of the court’s decision on the VAM clause. To be valid, the VAM clause should first satisfy the requirement that there is no violation of mandatory provisions. Second, there should be legal and factual possibility for the company to fulfil the VAM clause. Therefore, while it seems that the determination of the validity of the VAM clause is a question of “with whom to conduct a VAM”, it is actually still an application of the rules of the Contract Law on contract validity and the rules of the Company Law on share repurchase, capital reduction and profit distribution.

He Xin is a partner at PacGate Law Group. He can be contacted on +86 10 6530 9989 ext 822 or by email at ehe@pacgatelaw.com

Chen Xi is an associate at PacGate Law Group. He can be contacted on +86 10 6530 9989 ext 821 or by email at achen@pacgatelaw.com